White House National Economic Council Director Kevin Hassett has declared a recent New York Federal Reserve study the “worst paper” in the entire history of the Federal Reserve system—and suggested its authors deserve a timeout in the econ principal’s office.

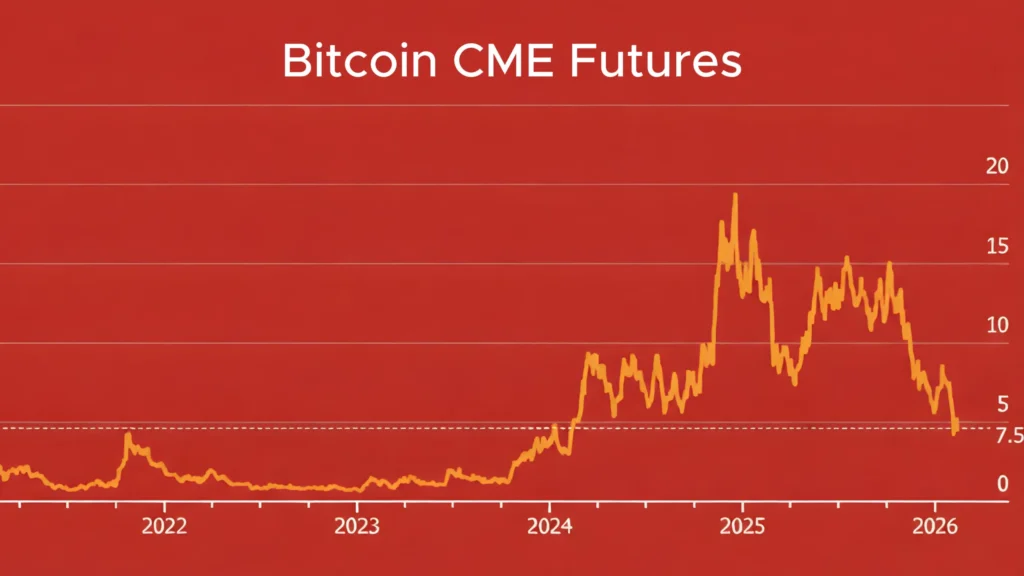

The New York Fed researchers calmly crunched the numbers and concluded that U.S. businesses and consumers footed nearly 90% of the bill for President Trump’s 2025 tariffs. Foreign exporters? They apparently absorbed only a sliver, leaving American wallets to handle the heavy lifting as average tariff rates climbed from under 3% to 13%.

Hassett, appearing on CNBC, didn’t mince words. He called the work an “embarrassment” built on analysis unfit for a freshman economics seminar, one that conveniently ignored how import volumes might have shifted or how global supply chains adapted.

Never mind that the study’s authors explicitly factored in monthly import values and duty revenues while tracking supply-chain responses—the director saw partisan headlines instead of scholarship.

The impact lands squarely on everyday economics with a side of comedy. Tariffs meant to make foreign goods pay up have instead acted like a sneaky sales tax on Americans, quietly hiking costs for companies that then pass them along in higher prices.

Shoppers might not see “Trump Tariff Surcharge” on receipts, but their grocery bills, electronics, and manufacturing inputs beg to differ. It’s the economic equivalent of promising free lunch and then billing the diners anyway—except the bill is real, and the lunch is now more expensive.

Tensions are running high in the usually buttoned-up world of central banking. The New York Fed and the Board of Governors offered the classic no-comment, preserving their independence like a vault door during a heist movie.

Researchers produce data to inform policy, not dictate it, yet here comes a top administration official calling for “discipline” over inconvenient findings. One might almost think the Fed’s job is to applaud rather than analyze.

Adding to the intrigue, Hassett once seemed a frontrunner to succeed Fed Chair Jerome Powell, whose term ends in May. Instead, Trump tapped critic Kevin Warsh, who promises a major Fed facelift if confirmed.

The administration has already launched probes into Fed headquarters renovations and floated firing a governor over unproven claims—moves that make the central bank’s famed independence look more like a polite suggestion than a bedrock principle.

Leave a Reply