Bitcoin’s grand romance with Wall Street was meant to be the stuff of fairy tales: suit-wearing institutions swooping in to tame the wild crypto beast with stability and respectability. Instead, the honeymoon ended abruptly, leaving Bitcoin nursing a 40%-plus hangover while American investors quietly slip out the back door.

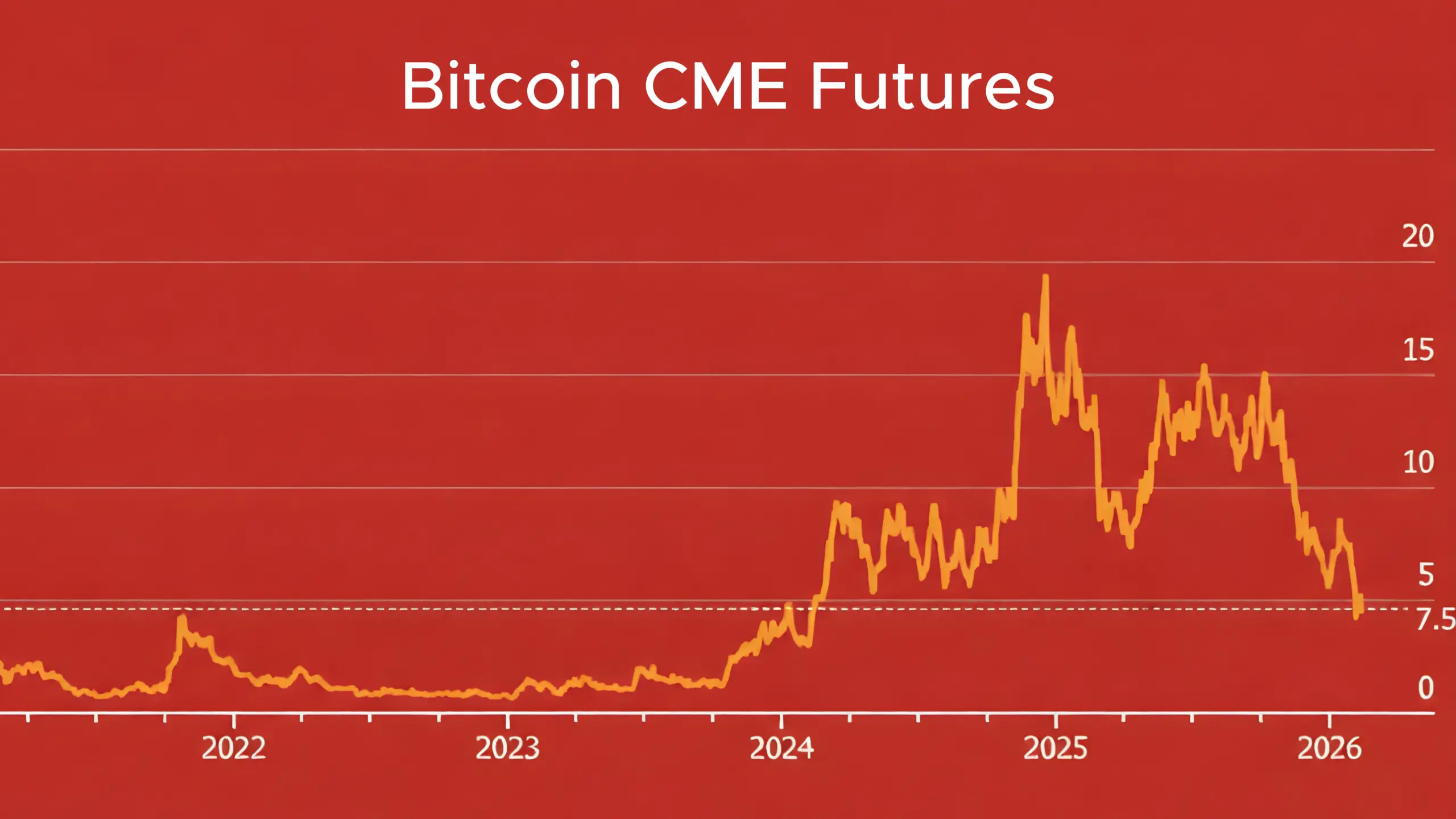

Since mid-October, roughly $8.5 billion has vanished from U.S.-listed spot Bitcoin ETFs, a slow-motion exodus that would make even the most patient bagholder check their exits. CME futures exposure has shrunk by about two-thirds from late-2024 highs, now lounging around $8 billion like a guest who overstayed brunch.

On Coinbase, where the big boys prefer to trade, prices keep dipping below Binance levels—a polite way of saying U.S. sellers are undercutting the party overseas.

Bitcoin itself sits around $67,500 on this crisp February Wednesday, stubbornly refusing to budge much, even as stocks flirt with new highs and gold gets treated like the reliable family heirloom it always was.

The real comedy lies in the grand institutional thesis that promised Bitcoin as the ultimate hedge. Investors piled in expecting protection from inflation, currency mischief, or stock market tantrums. What they got was an asset that sometimes fell harder and faster than the very threats it was supposed to shrug off.

Momentum chasers, spotting greener pastures, rotated into anything with actual upward momentum—global stocks, precious metals, perhaps even artisanal sourdough starter kits.

Hedge funds had been running those delightful basis trades: scoop up spot Bitcoin, short futures at a premium, pocket the spread like free money while claiming no directional opinion. For much of 2025, the math worked beautifully.

Then the spread squeezed tighter than Treasury yields, the trade lost its sparkle, and poof—those flows evaporated faster than enthusiasm at a tax seminar.

The market now feels thinner than a crypto bro’s promise to HODL forever. Leverage has dried up to levels not seen since before ETFs were a gleam in regulators’ eyes. Fewer forced buyers on the way up, fewer cushions on the way down.

Every modest bounce turns into a “sell-to-even” reunion, where holders high-five at break-even and bolt for the exits.

Wall Street’s embrace did deliver deeper liquidity and a shiny badge of legitimacy. Yet the same polished products—ETFs, yield overlays, option-selling schemes—smooth out the ride in calm seas only to magnify storms when real weather hits. Structured yield plays suppress volatility until they don’t, then amplify it like a megaphone at a library.

Leave a Reply