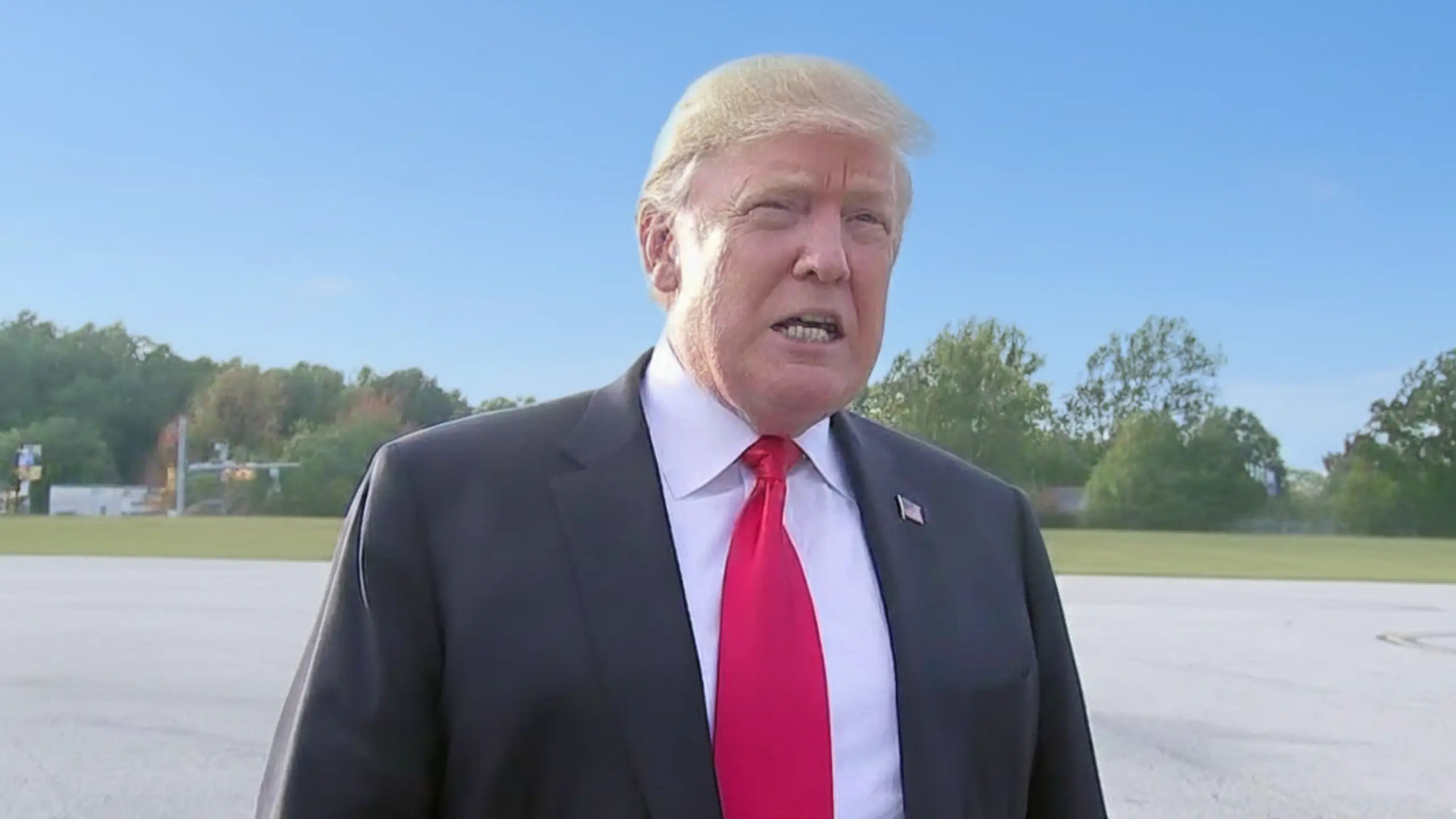

President Trump has launched a charm offensive on potential successors to Jerome Powell, kicking off with a sit-down today featuring the sharp-tongued former Fed governor Kevin Warsh. Sources whisper that this isn’t just coffee chat—it’s an audition where the key line is “I promise to crank down those interest rates like a bad thermostat.”

Wall Street’s morning coffee just got spiked with speculation, as traders eye a Fed chief who might treat rate cuts like complimentary hotel mints, potentially flooding markets with cheap money and turning every savings account into a sad, stagnant puddle.

Economists, meanwhile, are already drafting their “I told you so” memoirs, warning that this fast-track to lower rates could supercharge inflation faster than a Black Friday sale on fireworks, leaving consumers juggling grocery bills that rival mortgage payments—all while Trump’s “pretty good idea” of a pick promises to make monetary policy feel like a reality TV plot twist.

The White House shortlist reads like a who’s who of economic contrarians, with five finalists teed up for Trump’s discerning eye. Topping the heap is National Economic Council Director Kevin Hassett, the frontrunner who’s dodged more policy curveballs than a minor league pitcher, and he’s slated for a presidential powwow any day now.

Hassett’s edge? He’s the guy who can explain GDP growth without making your eyes glaze over like day-old donuts. Trump let slip on Air Force One Tuesday that he’s got his heart set on someone who’ll slash rates pronto—no ifs, ands, or inflation buts about it.

Enter Kevin Warsh, the day’s opening act, whose Fed tenure from 2006 to 2011 was marked by more dissent than a family reunion barbecue. Warsh didn’t just critique the central bank; he lobbed op-eds like verbal grenades, most recently urging the Fed in The Wall Street Journal to ditch its stagflation gloom and hail AI as the productivity fairy godmother that’ll sprinkle deflation dust on prices.

Picture Warsh in the hot seat today, armed with charts and charisma, pitching how artificial intelligence will outpace inflation like a caffeinated rabbit. Trump’s test? Will Warsh vow to lower rates faster than a yo-yo on a downhill slope? Sources say the stakes feel higher than a Vegas poker table, especially with Powell’s term expiring in May like an overstayed welcome.

The roster rounds out with Fed insiders Chris Waller and Michelle Bowman, steady hands who’ve navigated more boardroom squalls than a lighthouse keeper. Then there’s Rick Rieder, BlackRock’s fixed-income maestro, whose bond wizardry could make debt look as appealing as a well-aged whiskey—smooth, profitable, and just a tad intoxicating.

Treasury Secretary Scott Bessent is orchestrating this talent scout like a maestro with a deadline, but even he couldn’t dodge the drama: interviews nearly got scrapped last week ahead of Vice President JD Vance’s schedule, turning the process into a game of economic musical chairs. Trump, unfazed, told Politico he’s eyeing an early 2026 reveal, because why wait when you can tweet your way to monetary bliss?

Yet here’s the rub: Powell’s refusal to slash rates with the gusto of a Black Friday doorbuster has Trump seeing redder than a ledger in arrears. The current chair’s measured pace—holding steady amid whispers of economic headwinds—clashes with Trump’s vision of a Fed that prints prosperity like it’s going out of style.

Critics chuckle that this hunt smacks of shopping for a yes-man in a suit, but insiders insist it’s about fresh blood to tackle tomorrow’s puzzles. Warsh’s AI optimism, for instance, bets big on tech turbocharging jobs without the wage spiral, a forecast brighter than a solar-powered smile.

Leave a Reply