Tokyo, December 1, 2025 – In a confession that sent ripples through both Silicon Valley and the Tokyo Stock Exchange, SoftBank visionary Masayoshi Son admitted Monday that he literally cried while selling the company’s entire stake in Nvidia – a move he insists he would never have made if his wallet were infinitely deep.

The revelation instantly became the most expensive therapy session in corporate history, with Nvidia shares dipping slightly on the news that even Masa thinks they’re worth holding forever. Meanwhile, OpenAI employees reportedly celebrated by ordering extra avocado toast, secure in the knowledge that their next funding round will be paid for by the tears of a billionaire.

Financial Twitter spent the day toggling between sympathy and schadenfreude, producing memes of Son hugging a cardboard cutout of Jensen Huang while whispering “It’s not you, it’s me.”

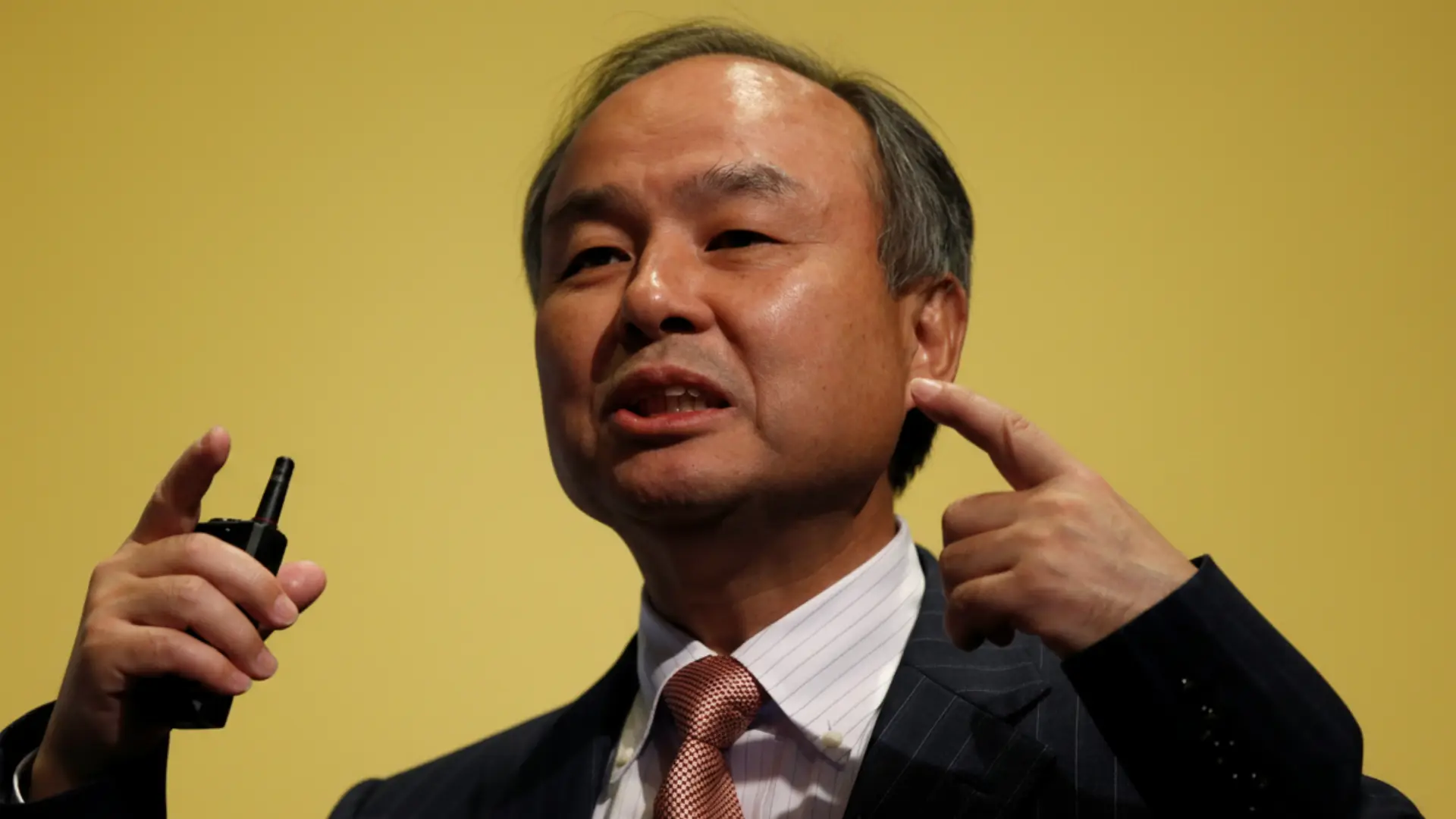

Masayoshi Son took the stage at the FII Priority Asia forum looking like a man who had just sold his favorite child to pay for his newer, shinier child.

He told the audience he didn’t want to sell “a single share” of Nvidia, currently the world’s most valuable company and the darling of every portfolio managers everywhere.

Unfortunately, building planet-scale data centers and writing nine-figure checks to Sam Altman requires actual money, not just visionary enthusiasm.

“I was crying to sell Nvidia shares,” Son said, somehow making a room full of hedge-fund managers feel genuine human emotion for three full seconds.

He then pivoted to defending the entire AI spending spree, dismissing bubble concerns with the confidence of someone who once lost $70 billion in a single year and still got invited to every good party.

“People who say it’s a bubble are not smart enough,” the 68-year-old declared, politely omitting the phrase “bless their hearts.”

His math: if AI eventually captures just 10% of global GDP, today’s trillions in spending will look like pocket change left on a Vegas blackjack table.

SoftBank’s recent shopping list includes the Stargate supercomputer project with Hon Hai, the full acquisition of chip designer Ampere, and another generous top-up for OpenAI before New Year’s Eve.

All of this apparently required liquidating the Nvidia position that had been the crown jewel of SoftBank’s portfolio and the main reason anyone still took Vision Fund 3 seriously.

Saudi Arabia’s Public Investment Fund, which once handed Son $45 billion for Vision Fund 1 and lived to tell the tale, watched the presentation with the calm resignation of a parent who knows the kid will eventually ask for the car keys again.

Governor Yasir Al-Rumayyan simply smiled and reminded everyone that the kingdom plans to nearly triple its Japan investments by 2030, suggesting the ATM is still open.

Son left the stage to polite applause and the quiet realization among attendees that “unlimited money” remains the one startup pitch even he can’t quite close.

Leave a Reply