Palantir Technologies unveiled earnings so dazzling they could light up a black hole, only for its stock to nosedive 7% faster than a caffeinated lemming off a cliff. CEO Alex Karp, ever the showman, declared these the “best results any software company has ever delivered,” but investors apparently mistook the report for a polite suggestion to sell.

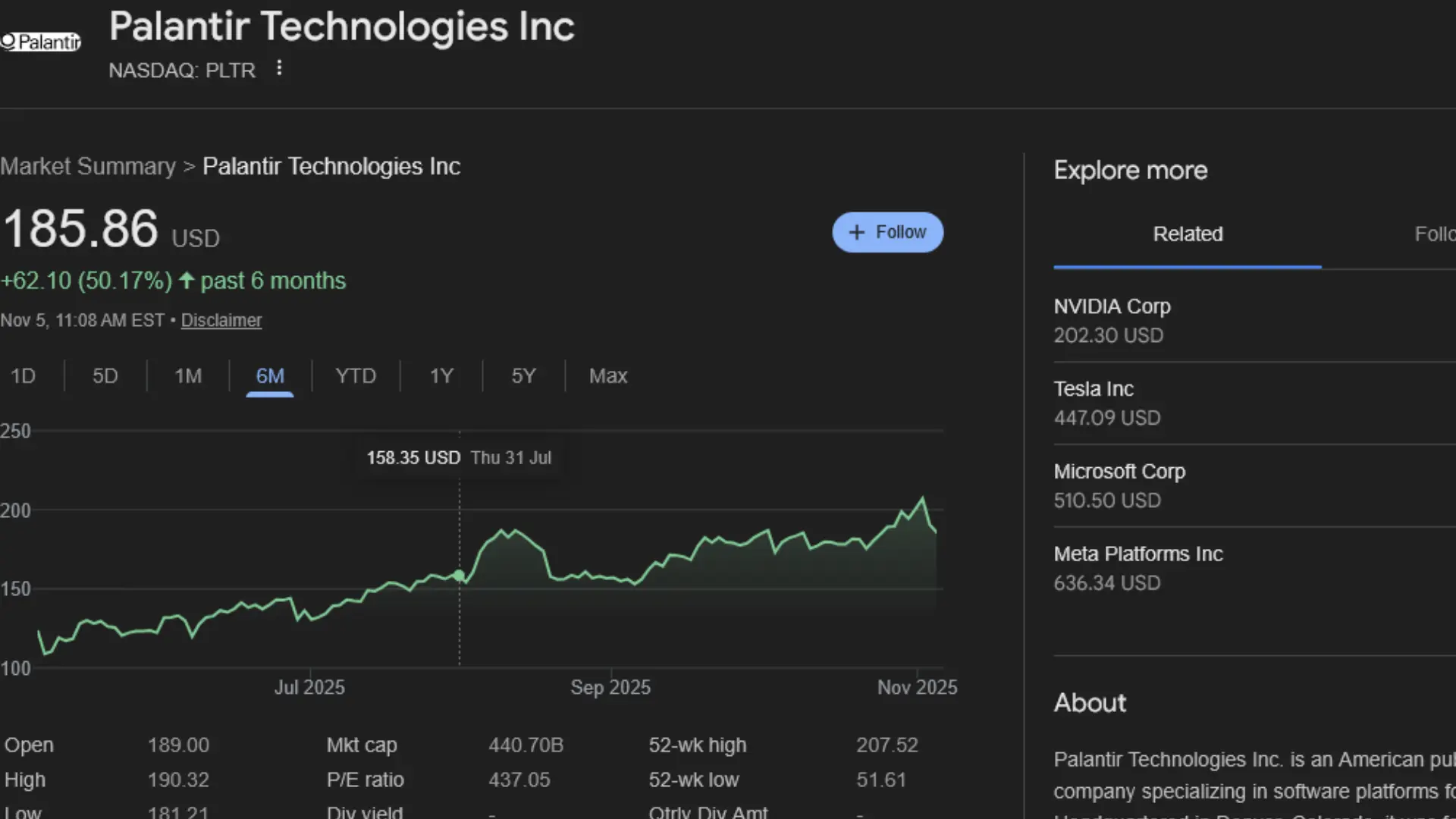

Picture the scene: Palantir’s U.S. revenue skyrocketed 80%, shattering estimates like a piñata at a bull market bash. The company, riding the AI wave like a surfer on steroids, extended its epic run—up over 170% this year alone. Yet the market, that fickle beast, decided to play hard to get.

Karp didn’t mince words in his post-earnings pep talk. “That’s not hyperbolic,” he quipped, taking a swing at skeptical analysts who’d been “wrong at every price.” It’s like telling your dietician they’re off-base while devouring a second slice of victory cake—delicious, but bound to raise eyebrows.

Analysts scratched their heads, unable to pin the sell-off on any one rogue line item. Dan Ives of Wedbush, who once crowned Palantir the “Messi of AI,” suggested investors might fear the party’s peaked. “This is as good as it gets,” they whisper, while Ives urges buying “all day long” for the decade-long AI dynasty ahead. It’s the financial equivalent of arguing over the last slice while the pizza’s still hot.

Palantir’s valuation? A forward P/E of 230, dwarfing the Magnificent Seven’s comfy 35. That’s not a multiple; it’s a multiplier for migraines. Loyalists defend it as visionary pricing for an AI stalwart, but critics see a house of cards built on hype taller than a giraffe in stilettos.

Enter Michael Burry, the “Big Short” oracle, who on Monday revealed his hedge fund’s cheeky bets against Palantir and Nvidia. If he nailed the housing crash, is this his next mic-drop moment? Palantir fans might scoff, but Burry’s track record has more plot armor than a Marvel villain.

The pressure cooker intensifies with Palantir’s meme-adjacent glow. One whiff of doubt, and sentiment shifts like sand in a beach volleyball game. Karp and his crew push back hard, insisting the stock’s a steal at any altitude. Fair enough—when your outlook screams “more, more, more,” who needs a reality check?

Broader AI jitters add fuel to the frenzy. At a Hong Kong summit, Goldman Sachs and Morgan Stanley suits warned of a 10% market drawdown lurking like an uninvited guest. Healthy cycle correction, they call it, but it sounds suspiciously like “brace for the hangover after the AI rager.”

Palantir’s boosters aren’t backing down. They tout the quarter as proof of unmatched prowess in a sea of software also-rans. Yet even stellar stats can’t outrun gravity when valuations flirt with the stratosphere—eventually, something’s gotta give, or at least wobble.

For now, the stock’s in limbo, a high-wire act without a net. Investors ponder: Is this a dip to dive into, or the first crack in the AI facade? Karp’s got his megaphone ready, analysts their crystal balls, and Burry? He’s probably shorting the popcorn for the show.

In the end, Palantir’s saga reminds us that in the stock market’s grand casino, even jackpot winners can leave the table feeling shortchanged. As the shares stabilize—or don’t— one thing’s clear: Expectation management’s harder than herding cats in a thunderstorm. And with AI’s bubble talk bubbling over, the next quarter might just be the plot thickener we didn’t know we needed.

Leave a Reply