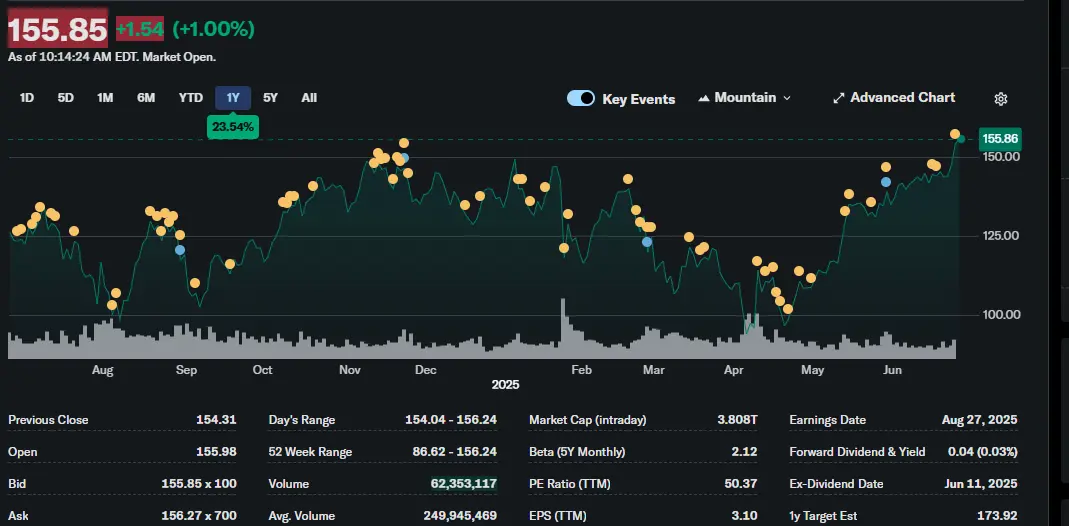

Wall Street’s favorite tech titan, Nvidia, snatched back its crown as the world’s most valuable company Thursday, with its stock climbing 0.8% to $155.51, pushing its market cap to a jaw-dropping $3.77 trillion.

The catalyst? A stellar earnings report from Micron Technology, Nvidia’s go-to supplier for high-bandwidth memory chips, which sent investors into a frenzy over the artificial intelligence (AI) trade. The Nasdaq Composite, not one to miss a good party, ticked up 0.4% to join the celebration.

Microsoft, the former top dog, took a backseat with its shares at $492.27 and a market cap of $3.66 trillion. Nvidia’s been outrunning the rest of the Magnificent Seven—think Tesla, Meta Platforms, Alphabet, Amazon, and Apple—boasting a 38% stock surge over the past three months. The others? They’re trailing behind, trying to keep up with Nvidia’s AI-fueled rocket ship.

Micron’s Wednesday earnings report was the talk of the town, proving the AI boom isn’t slowing down anytime soon. Chipmakers Broadcom, Marvell Technology, and Advanced Micro Devices also got in on the action, with their stocks rising after gains of 0.3% to 3.6% the previous day. It’s clear the market’s betting big on circuits and silicon to power the AI future.

Geopolitical storm clouds seem to be clearing, giving investors a chance to exhale. A cease-fire between Iran and Israel, following U.S. strikes on Tehran’s nuclear sites, appears to be holding steady. This newfound calm has traders ditching safe-haven assets and diving back into riskier bets, AI stocks.

“Nvidia’s riding high, and the market’s remembering the AI revolution is still in full swing,” said AJ Bell analyst Dan Coatsworth, probably while sipping coffee and marveling at the numbers. The market’s mood shift comes as no surprise—when global tensions ease, investors tend to rediscover their love for tech stocks. It’s a bit of a rollercoaster, but who doesn’t enjoy a good thrill?

Nvidia’s dominance isn’t just about flashy chips; it’s about cold, hard cash flow. The company’s been capitalizing on the insatiable demand for AI infrastructure, from data centers to supercomputers. Micron’s earnings only poured fuel on the fire, showing that the supply chain for AI tech is as robust as ever.

Other chipmakers are catching the wave too. Broadcom’s stock popped 1.03%, while Advanced Micro Devices inched up 0.15%. Marvell Technology, not to be left out, joined the upward march, signaling that the semiconductor sector is still the belle of the ball.

The Magnificent Seven, while still magnificent, are playing second fiddle to Nvidia’s blockbuster performance. Tesla’s been grappling with tariff worries, and Apple’s iPhone sales in China haven’t exactly set the world on fire. Nvidia, meanwhile, keeps churning out chips that make AI dreams come true.

Investors are clearly feeling the FOMO. After weeks of hiding in gold and bonds, they’re back to throwing money at tech stocks. The Iran-Israel cease-fire, possibly nudged along by some diplomatic wizardry, has given them the green light to go all-in on AI.

Let’s not forget the bigger picture: AI’s not just a buzzword; it’s a multi-trillion-dollar industry in the making. Nvidia’s chips power everything from chatbots to autonomous vehicles. And with Micron delivering the goods, the supply chain looks tighter than a Silicon Valley dress code.

The market’s recent jitters over tariffs and trade wars seem to be fading. A federal court’s decision to block some of President Trump’s sweeping tariffs helped soothe nerves. Chipmakers, sensitive to trade policy hiccups, breathed a collective sigh of relief.

Nvidia’s stock has been on a tear, and Thursday’s 0.8% bump was just the cherry on top of a 4.3% surge the day before. The company’s market cap briefly dipped earlier this year after a Chinese AI chatbot shook things up, but it’s back with a vengeance. Investors are betting Nvidia’s GPUs will remain the gold standard for AI.

Micron’s role can’t be overstated. As a key supplier, its strong earnings signal that the AI ecosystem is firing on all cylinders. High-bandwidth memory chips aren’t sexy, but they’re the unsung heroes keeping Nvidia’s AI empire humming.

The broader tech sector’s feeling the love too. The S&P 500’s tech index is on track for its best monthly gain since November 2023, up 11% in May. Super Micro Computer and Seagate Technology are leading the charge, with gains topping 29%.

Nvidia’s not alone in this rally. Posts on X show traders buzzing about the chipmaker’s record-breaking run, with some calling it the “comeback of the century.” Sentiment’s overwhelmingly bullish, as investors see AI as the next big thing—again.

The cease-fire’s role in calming markets can’t be ignored. With global tensions dialed down, at least for now, risk appetite is back in full force. Investors are ditching their bunkers and piling into stocks that scream “future.”

Nvidia’s journey to the top hasn’t been without bumps. A $589 billion market cap wipeout in January, courtesy of a Chinese AI startup, had traders sweating. But with Thursday’s gains, it’s clear Nvidia’s shrugging off the competition and reclaiming its throne.

Leave a Reply