Nvidia’s Jensen Huang confessed to an insatiable craving for TSMC wafers, fueling the semiconductor world’s hottest romance since silicon met sand. With Blackwell chips flying off virtual shelves faster than free samples at a tech buffet, Huang’s pleas for more silicon real estate have TSMC blushing and the AI boom blushing harder.

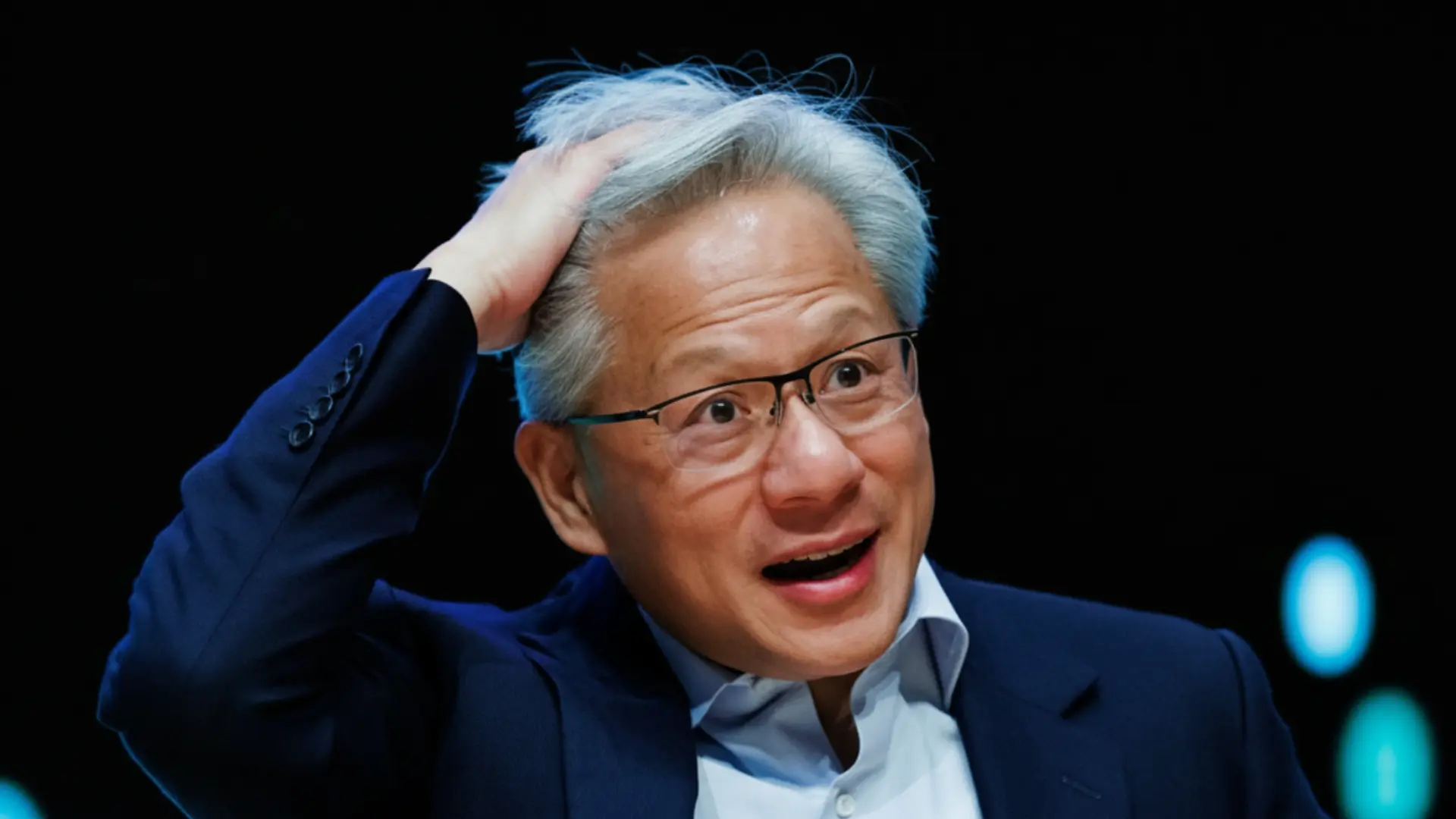

Huang dropped this wafer bombshell at a cozy gathering in Hsinchu, Taiwan, hosted by Nvidia’s eternal flame, TSMC. “We’re building GPUs, CPUs, networking gear, switches—heck, the whole Blackwell circus tent,” he quipped to reporters, his eyes gleaming like a kid eyeing the last cookie.

TSMC’s C.C. Wei coyly admitted Huang had whispered a wafer count in his ear. But shh—it’s classified tighter than a spy novel’s redacted pages. “He’s asked for wafers,” Wei said, dodging specifics like a pro dodgeball champ.

Huang, on his fourth Taiwan jaunt this year—like a frequent flyer collecting miles for motherboard upgrades—lavished praise on TSMC. “Their wafer wizardry makes our wins possible,” he beamed, crediting them for Nvidia’s rocket ride to glory.

Speaking of glory, October saw Nvidia shatter the $5 trillion market cap barrier, a feat that left Wall Street googly-eyed. Wei dubbed Huang the “five-trillion-dollar man,” as if he’d traded his soul for stock splits and a lifetime supply of ramen-flavored crisps.

But amid the confetti, Huang faced the elephant in the cleanroom: memory shortages. “Business is booming like a fireworks factory on payday,” he shrugged. “Shortages? Sure, but of different things—like weekends off.”

He name-dropped his memory dream team: SK Hynix, Samsung, Micron. “These folks are scaling up capacity faster than a viral dance challenge,” Huang gushed, revealing Nvidia’s already clutching the shiniest sample chips from each.

Price hikes on memory? Huang played coy diplomat. “That’s their sandbox—let them build castles or moats as they please.” No price wars on his watch; just polite nods and knowing winks.

Over in Seoul, SK Hynix spilled the tea last week: their 2025 chip lineup is sold out, drier than a desert TED Talk. They’re pumping investments sky-high, betting the AI “super cycle” will outlast even the longest Netflix binge.

Samsung chimed in with equal gusto, flirting with Nvidia over next-gen HBM4 chips. “We’re in close discussions,” they teased, like high school sweethearts passing notes in class. Blackwell’s brainpower demands nothing less than bandwidth fit for a data deluge.

Yet, as the party raged, a geopolitical buzzkill loomed. Huang shut down whispers of Blackwell shipments to China faster than a firewall on steroids. “No active talks,” he stated flatly on Friday, blaming the Trump administration’s ironclad embargo—lest these chips supercharge Beijing’s military marches or AI escapades.

It’s a reminder that in the chip chase, not every door swings open. While Nvidia feasts on global demand, U.S. export rules play bouncer, turning potential deals into diplomatic no-shows.

Huang’s Taiwan tango underscores the AI arms race’s delicate dance: insatiable hunger meets supply chain sorcery, all under the shadow of trade tightropes. As Blackwell beckons buyers worldwide, one wonders if wafers will run out before the jokes do.

For Nvidia, it’s less a shortage scare and more a symptom of success so voracious, it’s spawning spin-off shortages in coffee for exhausted engineers. Huang’s wafer woes? Just the growing pains of a trillion-dollar toddler learning to crawl toward infinity.

In Hsinchu’s humming halls, alliances solidified like epoxy glue. TSMC’s Wei and Huang swapped secrets and smiles, plotting the next chapter in silicon symbiosis. If demand holds, Blackwell won’t just power AIs—it’ll redefine “chip off the old block” as a wafer avalanche.

As Huang jetted off, his “five-trillion-dollar” aura intact, the industry exhaled. Shortages may shuffle the deck, but with memory maestros in tow, Nvidia’s hand looks unbeatable. Except, perhaps, against the unyielding grip of geopolitics—where even super chips play by earthly rules.

Leave a Reply