The world’s financial markets are treating the U.S. jumping into the Israel-Iran conflict with all the enthusiasm of a Monday morning Zoom meeting. Despite the U.S. bombing Iranian nuclear sites, investors are sipping their coffee and shrugging, convinced this geopolitical dust-up won’t ruin their portfolios.

By 9:30 a.m. in London, the MSCI World index, tracking over a thousand companies, barely flinched, dipping just 0.1%.

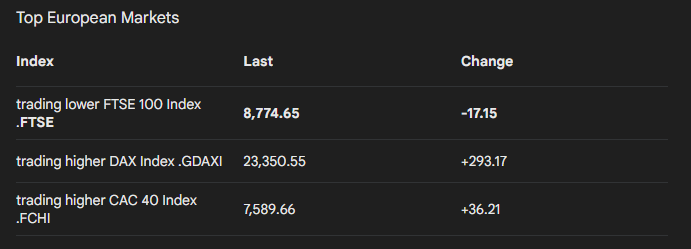

European stocks started the day with a mild panic but quickly recovered, with the Stoxx 600 index ending slightly higher after an early sell-off. U.S. stock futures, tied to the S&P 500, perked up by 0.2%, as if to say, “War? What war?” Safe-haven assets like gold and the Swiss franc, usually the go-to for nervous investors, barely budged, with gold dropping 0.2% to $3,359 an ounce and the franc flat against the dollar.

Analysts are scratching their heads, wondering why markets aren’t in a tizzy. Dan Ives from Wedbush called the U.S. strikes a “relief,” arguing the nuclear threat in the region is kaput, and the conflict won’t spread. He’s betting this drama stays “isolated,” like a reality show nobody watches.

Meanwhile, Iran’s foreign minister is waving the “all options” flag, hinting at retaliation, while their parliament greenlit closing the Strait of Hormuz. This narrow waterway handles 20 million barrels of oil daily, making it the global equivalent of a coffee shop’s only espresso machine.

If Iran shuts it down, oil prices could skyrocket past $100 a barrel, sending stocks into a 10% nosedive and investors scrambling for gold bars and bomb shelters.

But don’t hold your breath for that doomsday scenario. Marko Papic from GeoMacro Strategy says Iran closing the Strait is about as likely as a unicorn winning the Kentucky Derby. He points out Tehran’s threats to block the Strait in 2011, 2012, and 2018 never materialized, suggesting it’s just their favorite bluff.

Papic also notes Iran’s retaliation options are slim, akin to a kid with a slingshot facing a tank. “Tehran knows the U.S. would respond with a swift, punitive smackdown,” he said, implying Iran might grumble but won’t escalate. Peter Boockvar from Bleakley Financial Group agrees, saying if Iran accepts its nuclear dreams are toast, markets could stay calm and carry on.

Ed Yardeni from Yardeni Research is positively giddy, claiming the U.S. strikes have restored America’s military swagger. He’s so bullish he’s targeting 6,500 for the S&P 500 by the end of 2025, unfazed by the Middle East’s latest kerfuffle.

Yardeni thinks the region’s in for a “radical transformation” now that Iran’s nuclear facilities are rubble, though he admits predicting geopolitics is trickier than picking lottery numbers.

Oil markets, however, are keeping one eye open. Brent crude and U.S. crude futures hit their highest since January, with Brent at $80.28 and U.S. crude at $76.73, as traders brace for Iran’s next move. Freight rates for oil tankers through the Strait of Hormuz jumped 24% to $1.67 per barrel, hinting at some jitters among shippers.

The consensus among experts is that markets see this conflict as a contained spat, not a global crisis. They’re betting Iran won’t pull the Strait of Hormuz card, knowing it’d hurt their own oil exports to China more than anyone else. Plus, the U.S. Fifth Fleet in Bahrain is ready to keep the Strait open, making a blockade about as effective as a paper towel in a hurricane.

Still, traders aren’t completely snoozing. They’re watching Iran’s next move, ready to hit the panic button if Tehran does something rash. For now, though, markets are acting like this war is just background noise, with investors more worried about their lunch orders than a Middle East meltdown.

As the U.S., Israel, and Iran trade barbs, the financial world seems to be saying, “Wake us up when something really happens.” Whether that’s wisdom or wishful thinking, only time will tell. Until then, expect markets to keep calm, carry on, and maybe sneak in a nap.

Leave a Reply