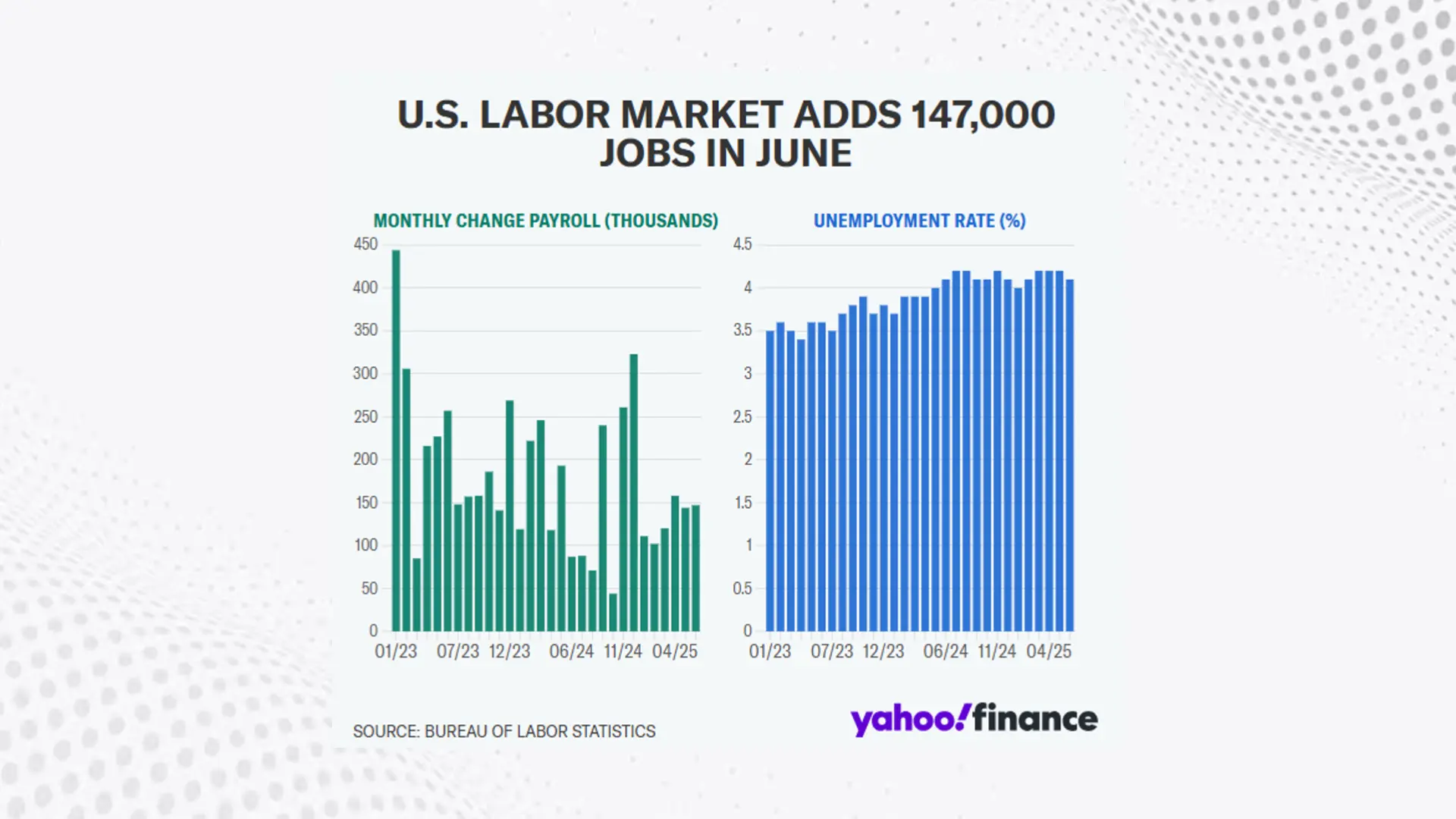

The US labor market in June decided to throw a surprise party, adding 147,000 nonfarm payrolls when economists were only expecting a modest 106,000. The unemployment rate, in a cheeky twist, dropped to 4.1% instead of climbing to the predicted 4.3%. Apparently, the economy didn’t get the memo about slowing down.

May’s numbers got a slight makeover, with revised figures showing 144,000 jobs added instead of the previously reported 139,000. The unemployment rate held steady at 4.2%, refusing to budge. It’s as if the labor market is flexing its muscles, saying, “Look at me, I’m still strong!”

RSM chief economist Joe Brusuelas was practically giddy, telling Yahoo Finance, “No tariff stress here, just a solid payroll number!” He added that this points to an economy that’s slowing but still strutting its stuff. The labor market is like that friend who shows up to a casual gathering in a tuxedo—overdressed but impressive.

Wages in June crept up by 0.2% from May, landing at a 3.7% increase year-over-year. Economists, who were betting on a 0.3% monthly bump and 3.8% annual rise, must’ve raised an eyebrow. Meanwhile, the labor force participation rate dipped slightly to 62.3% from 62.4%, as some folks apparently decided to take a summer break from job hunting.

Government jobs stole the spotlight, adding 73,000 workers and accounting for nearly half of June’s gains. It seems bureaucrats were in high demand, possibly to handle all the paperwork from new trade policies. The private sector, however, wasn’t feeling as festive, with ADP reporting a surprising 33,000 job cuts—the first private-sector loss since March 2023.

Oxford Economics’ Nancy Vanden Houten warned that slower labor force growth could keep the unemployment rate low while the number of jobless folks creeps up. It’s a bit like a magic trick—now you see the jobs, now you don’t! The labor market is juggling some complex dynamics, and everyone’s watching to see what’s next.

The Federal Reserve, always the cautious parent at the economic party, saw its July interest rate cut odds plummet from 24% to a mere 5%, according to the CME FedWatch Tool. September’s cut chances also took a hit, dropping from 94% to 78%. The Fed seems to be saying, “Not so fast, let’s keep the rates steady and see how this plays out.”

Recent data suggests the labor market is cooling, but not crashing. The May JOLTS report showed job openings hitting their highest level since November 2024, while quits and hiring rates stayed near decade lows. It’s a mixed bag—think of it as an economic fruit salad with some sweet spots and a few sour notes.

ADP’s Nela Richardson told Yahoo Finance that hiring momentum has definitely slowed, but she’s not predicting a job-loss apocalypse for the second half of 2025. The labor market is more like a car coasting downhill than one screeching to a halt. Still, continuing unemployment claims hit a four-year high, hinting at some bumps in the road.

Despite the private sector’s job cuts, the overall labor market is holding its ground. The June report suggests resilience, with government hiring leading the charge. It’s as if the economy is doing a balancing act on a unicycle while juggling flaming torches—impressive, but you can’t help but hold your breath.

Investors, meanwhile, are keeping a close eye on these numbers, trying to guess the Fed’s next move. The strong jobs data has them rethinking rate cut bets, with markets adjusting faster than a barista during a morning coffee rush. The economy’s stability is a relief, but everyone’s wondering how long it can keep up the act.

The June jobs report paints a picture of a labor market that’s still got some swagger. It’s not sprinting, but it’s not tripping over its own feet either. With trade policy uncertainties and tariff talks looming, the economy is walking a tightrope with a confident grin.

Leave a Reply