JPMorgan Chase has decided to flex its digital muscles with a snazzy update to its mobile app. Investors can now research and snap up bonds and brokered certificates of deposit (CDs) right from their phones, according to a CNBC scoop. It’s as if the bank said, “Why just check your balance when you can also play Wall Street tycoon?”

The new tools let users create custom screens to compare bond yields while simultaneously peeking at their checking account. Paul Vienick, JPMorgan’s head of online investing, proudly declared the goal was to make buying fixed income as easy as ordering takeout. The bank took its stock and ETF trading simplicity and sprinkled it onto the bond market like financial fairy dust.

Despite being the big dog in banking, JPMorgan’s online brokerage game has been more of a chihuahua compared to giants like Charles Schwab or Fidelity. The bank recently hit $100 billion in assets under management, which sounds impressive until you realize the competition has been stacking cash for decades. Still, JPMorgan’s not sweating it—they’re ready to chase the big leagues.

Back in 2018, JPMorgan tried to woo self-directed investors with a free trading service called “You Invest,” hyped up with U.S. Open tennis ads. By 2021, it was clear the name wasn’t sticking, and CEO Jamie Dimon bluntly admitted, “We don’t think it’s a very good product yet.” Ouch, talk about a corporate roast!

Enter Paul Vienick, hired in October 2021 after stints at TD Ameritrade, Morgan Stanley, and Bank of America. His mission? Turn JPMorgan’s online investing into something that doesn’t make the boss cringe. The pivot to “Self-Directed Investing” was less flashy but more functional, like trading a sports car for a reliable SUV.

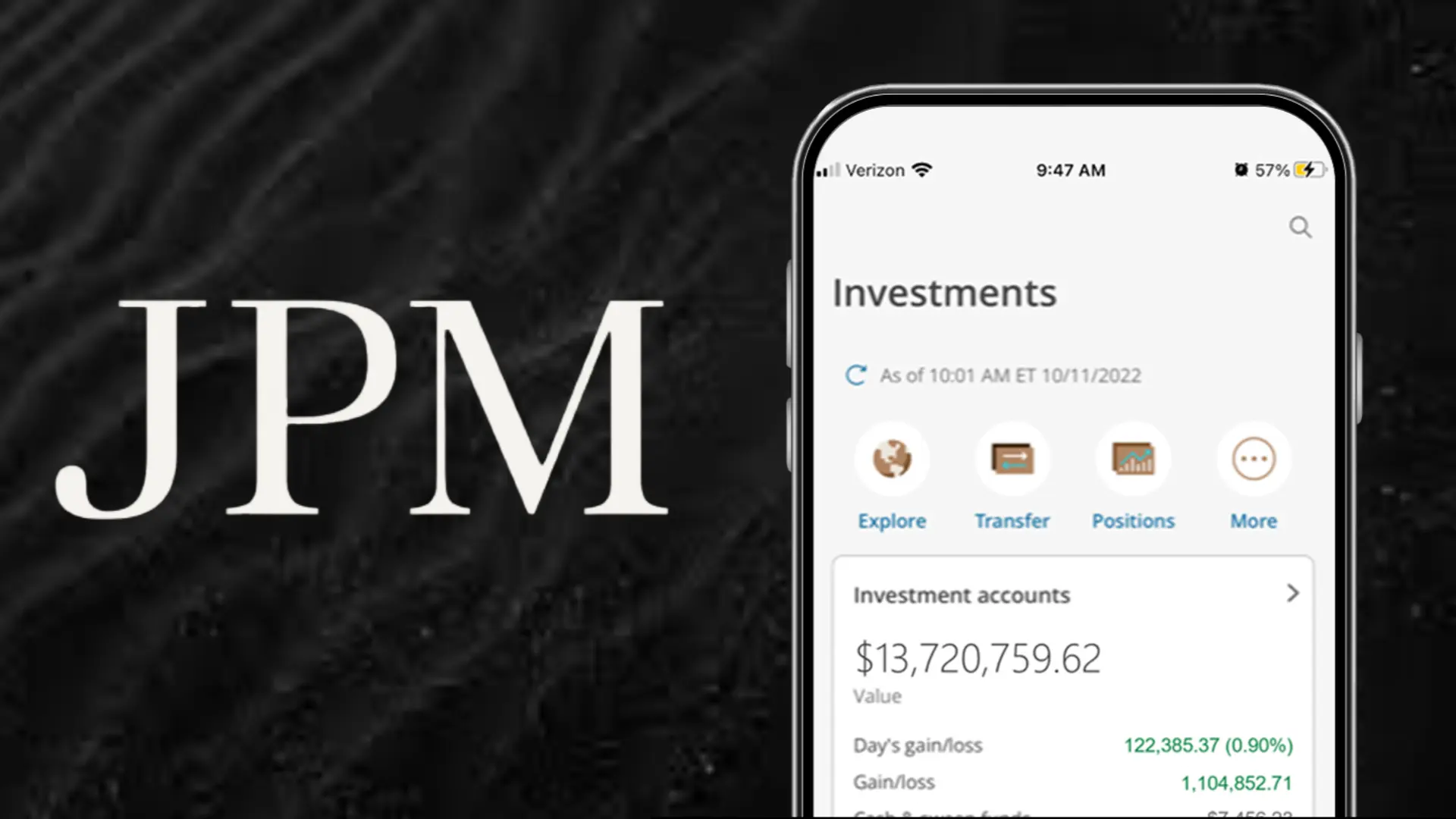

Vienick’s team has been busy. The app now lets users trade over 800 stocks and ETFs for as little as $5, with no commissions, per JPMorgan’s website. They’ve also added tools to track portfolio performance against the S&P 500 and even the Consumer Price Index, because who doesn’t love measuring their wealth against inflation? It’s all part of a plan to make investors feel like they’re running their own hedge fund from their couch.

The bank’s latest move targets “engaged investors”—those folks who trade stocks a few times a month and prefer buying bonds directly instead of through mutual funds. To sweeten the deal, JPMorgan’s offering up to $700 for transferring funds to their platform, because nothing says “invest with us” like cold, hard cash. Next up, they’re working on after-hours stock trading, so night owls can get their market fix.

JPMorgan’s not just throwing digital darts and hoping they stick. They’re leveraging their massive branch network, hefty balance sheet, and Dimon’s rock-star reputation to compete. Vienick’s got big dreams, claiming the self-directed business could hit a trillion dollars, which is roughly the GDP of a small country.

The bank’s also eyeing wealthy clients, boosted by their 2023 acquisition of First Republic. Half of America’s 19 million affluent households already bank with JPMorgan, but only 10% trust them with their investing dollars, per Jennifer Roberts, CEO of Chase Consumer Banking. The new tools aim to change that, making it easier to manage everything from credit cards to bond portfolios in one app.

Brokered CDs, for those wondering, are like regular CDs but with a twist—they’re traded like bonds and subject to market price swings. They’re FDIC-insured up to $250,000 per bank, per ownership category, but callable, meaning the issuing bank might yank them back early. It’s a bit like lending your money to a bank that might ghost you before the due date.

The app’s redesigned trade ticket and improved screeners make investing feel less like a tax form and more like a game. Users can toggle between buying shares or dollar amounts, and the interface now shows recent search history for quick access. It’s all about making investing so seamless you might accidentally buy a bond while waiting for your coffee.

JPMorgan’s not stopping here. They’re planning to roll out more features, like margin trading on options and fixed income, because apparently stocks and ETFs weren’t enough. The bank’s betting that combining banking and investing in one app will convince customers to consolidate their financial lives with them.

Vienick emphasized education over gamification, ensuring the app explains credit risk and bond structures clearly. No flashy prompts here—just solid info for investors who want to know what they’re buying. It’s like giving users a financial textbook, but one they might actually read.

Skeptics might wonder if a bank this big can keep up with nimble digital brokers. But with Dimon’s willingness to pour billions into tech, JPMorgan’s not messing around. They’re aiming to be the one-stop shop where you pay your credit card bill and build a bond ladder in the same breath.

Will JPMorgan hit that trillion-dollar mark? It’s a tall order, but with their new app features, they’re certainly making a case. For now, investors can enjoy the upgraded tools and maybe, just maybe, feel a little bit like a Wall Street hotshot—minus the suspenders.

Leave a Reply