The May Consumer Price Index (CPI) report dropped, and inflation decided to hit the snooze button. Prices crept up a measly 0.1% from April, according to the Bureau of Labor Statistics. Economists, who predicted a 0.2% rise, are probably scratching their heads or just napping alongside inflation.

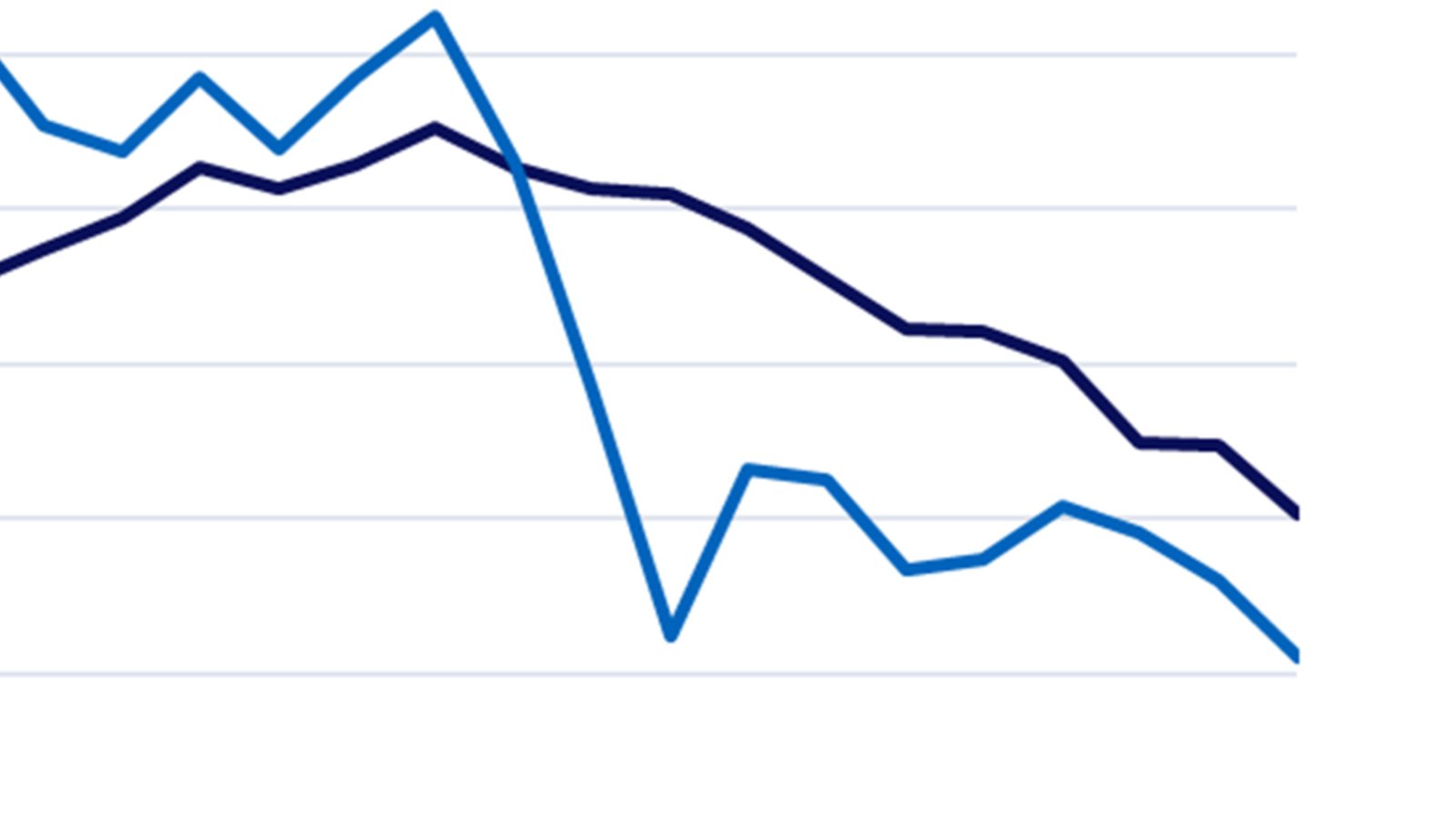

Yearly, the CPI ticked up to 2.4%, a smidge higher than April’s 2.3%, which was the lowest since February 2021. Core CPI, the fancy metric that ignores food and energy because they’re too wild, held steady at 2.8% annually. Monthly core prices inched up 0.1%, dodging the expected 0.3% jump.

Cars and clothes, the usual suspects for tariff-induced price hikes, decided to play nice. New vehicle prices dropped 0.3%, and used cars and trucks fell 0.5%. Joe Brusuelas, RSM’s chief economist, chuckled to Yahoo Finance, saying tariffs haven’t crashed the party yet.

Brusuelas warned not to get too cozy. Companies might slap on 10% to 15% price hikes soon. Those tariffs are like uninvited guests who haven’t arrived but will definitely eat all your snacks.

President Trump’s “Liberation Day” tariff announcements in April had markets quaking in their boots. Most of those “reciprocal” tariffs got a timeout, but a 10% baseline duty still looms over most countries. Mexico, Canada, and China are stuck with their own special tariff flavors, like fentanyl-related fees and hefty 30% duties on Chinese goods.

On Wednesday, the U.S. and China shook hands on a trade truce framework. Trump gave it a thumbs-up, saying it’s “done” pending a final nod from him and China’s President Xi Jinping. Wall Street’s still betting on higher prices by year’s end, though.

Claudia Sahm, a former Fed economist now at New Century Advisors, shrugged at the report. She said it’s a snapshot of last month, not a crystal ball for December. Inflation’s path back to the Fed’s 2% goal is still a foggy road.

The Federal Reserve, watching this like a hawk, is expected to keep interest rates steady next week. Markets are yawning, with no big moves in sight. Meanwhile, consumers are just hoping their wallets don’t get a tariff-induced wedgie.

Economists are buzzing about potential price spikes as tariffs start to bite. The Yale Budget Lab estimated a 1.7% price increase, costing households about $2,800 annually. That’s enough to make anyone rethink their avocado toast addiction.

Back in April, inflation was already cooling, with CPI at 2.3% yearly. May’s report shows it’s still chilling, but tariffs could heat things up. Businesses stocked up on goods before the tariffs hit, which might explain the calm before the storm.

Food prices, however, decided to join the party, climbing 0.3% in May after a 0.1% dip in April. Shelter costs, the heavyweight in the CPI ring, also rose 0.3%. Energy prices, on the other hand, took a 1% dive, thanks to cheaper gasoline.

The stock market barely blinked at the report, with major indexes lounging like they’re on a beach vacation. The S&P 500 even turned positive for the year, shrugging off tariff fears. Posts on X echoed this, with users noting inflation’s still under control for now.

Some X users, like @CiovaccoCapital, pointed out the core CPI’s 0.1% rise was a surprise. Others, like @BenBSP, called it bullish for markets, hinting at a green push. But @KobeissiLetter warned the Fed’s staying cautious until tariffs show their true colors.

The Fed’s favorite inflation gauge, the core PCE price index, was at 2.3% in March. Economists like Gus Faucher from PNC Financial predict tariffs will push prices up soon. It’s like waiting for a sneeze after someone coughs in your face.

Consumers are already bracing for impact. A Harris/Guardian poll found six out of ten Americans are delaying big financial goals. The University of Michigan’s survey showed inflation expectations at a lofty 6.5%, the highest since 1981.

Businesses, meanwhile, are playing a waiting game. Many built up inventories to dodge early tariff hits. Conrad DeQuadros from Brean Capital says we’ll see the real impact by mid-year, when those stockpiles run dry.

The trade truce with China might soften the blow, but tariffs are still high. The Yale Budget Lab pegged the effective tariff rate at 17.8%, a level not seen since 1934. That’s enough to make your wallet nostalgic for simpler times.

For now, inflation’s taking a breather, but don’t put away your umbrella. Tariffs are lurking, ready to rain on your budget. The May CPI report is a calm moment, but the forecast screams turbulence ahead.

Leave a Reply