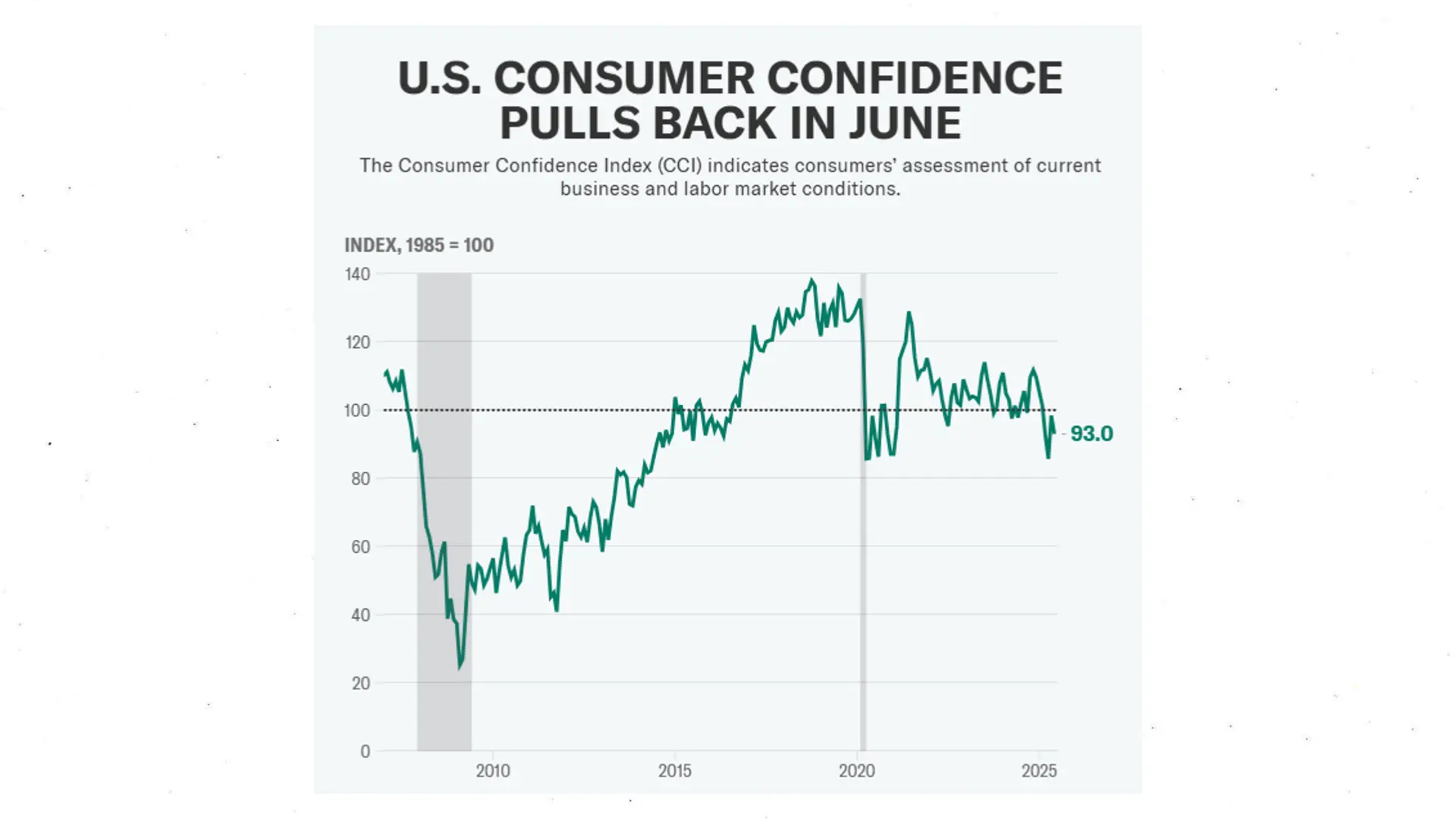

Americans in June decided their economic optimism needed a nap, according to the Conference Board’s latest consumer confidence index. The reading slumped to 93, down from May’s peppy 98.4, missing economists’ hopes for a sprightly 99.8. It’s as if the nation’s mood caught a cold and stayed home.

Tariffs are the grumpy cat of this story, hissing at shoppers’ peace of mind. Stephanie Guichard, senior economist at the Conference Board, noted that tariffs topped consumers’ worry list, tied to fears of pricier goods and a sulky economy. Inflation and high prices also gatecrashed the concern party, refusing to leave.

The Yale Budget Lab pegs the effective U.S. tariff rate at 14.7%, a level not seen since 1938, when radios were the hottest tech. This rate dropped from a lofty 25% in April, but it’s still poking wallets with a sharp stick. Shoppers are side-eyeing their budgets, unsure what’s next.

June’s survey cutoff was June 18, before the U.S. joined the Iran-Israel scuffle by targeting Tehran’s nuclear sites. Guichard said geopolitics barely registered on consumers’ radar, overshadowed by tariff terrors. Apparently, global tensions are less scary than a potential $50 t-shirt.

Jobs are another sore spot, with only 29.2% of folks calling them “plentiful,” down from 31.1% in May. Meanwhile, 18.1% grumbled that jobs were “hard to get,” a slight dip from 18.4%. The labor market differential, a fancy term for job market vibes, hit its lowest point since March 2021 at 11.1 percentage points.

This gloomy job outlook aligns with fewer job openings since January and unemployment claims creeping up to an eight-month high. It’s as if the job market is a party where the snacks ran out early. Consumers are bracing for leaner times.

The expectations index, which gauges hopes for income, business, and jobs, slid to 69 from 73.6 in May. That’s well below the 80 mark, which screams “recession ahead” louder than a foghorn. Guichard noted pessimism about future business and job prospects, with income hopes also taking a hit.

Retailers are feeling the pinch, too, with some warning of price hikes as tariffs loom like uninvited guests. The Organization for Economic Co-operation and Development predicts U.S. inflation could hit 4% by year’s end, up from current levels. That’s enough to make anyone clutch their wallet tighter.

Federal Reserve Chair Jerome Powell is playing the cautious card, warning of “stagflation” risks—rising prices with a sluggish economy. The Fed kept interest rates steady at 4.25%-4.50%, watching tariffs like a hawk. Cutting rates could spark growth but might also fuel price spikes.

Despite a brief confidence boost in May when Trump paused some tariffs, June’s data suggests the party was short-lived. Consumers across all ages, incomes, and political stripes are feeling the blues, with Republicans taking the biggest mood hit. It’s a bipartisan grumble fest.

The Conference Board’s report hints at a spending slowdown later this year. Shoppers might be frontloading purchases now, fearing tariff-driven price jumps. It’s like buying all the toilet paper before a storm, but with appliances and cars.

Economists are split on what’s next. Some, like Robert Frick from Navy Federal Credit Union, warn that tariff effects could sour moods further when prices climb. Others hope tax cut talks might perk things up by 2026, assuming tariffs don’t crash the party first.

The labor market, while wobbly, isn’t collapsing yet. April’s job report showed a surprising 177,000 jobs added, with unemployment steady at 4.2%. But with job openings shrinking, it’s like the economy is tiptoeing on a tightrope.

Retail giants like Walmart and Target are bracing for impact. Walmart slashed its profit forecast, citing tariff pressures, while Target reported slipping sales. It’s as if shoppers are already practicing for a budget diet.

Geopolitical noise, like the Iran-Israel tensions, barely moved the needle for consumers. The survey suggests Americans are more worried about their grocery bills than global conflicts. A carton of eggs apparently trumps international headlines.

This confidence dip mirrors trends from earlier this year, when tariffs first rattled cages. Back in March, confidence hit a four-year low, with fears of recession and inflation running high. June’s retreat feels like a sequel nobody asked for.

The Fed’s in a pickle, balancing inflation and growth. Powell’s wait-and-see stance means no rate cuts soon, leaving consumers to navigate tariff turbulence. It’s like steering a ship through a storm with a foggy map.

Leave a Reply