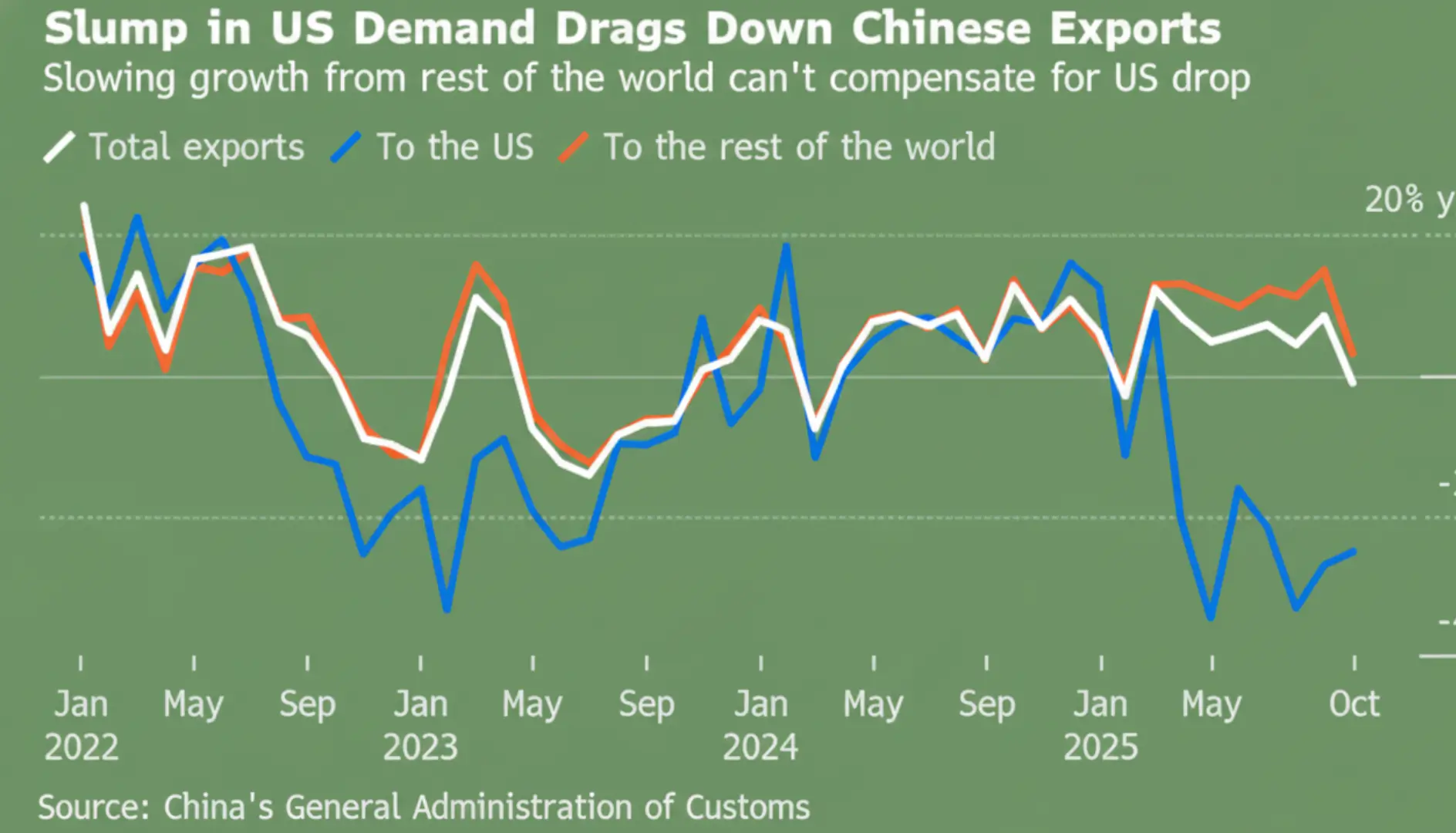

China’s exports decided October was the month to take an unscheduled vacation, shrinking 1.1% from last year—the first dip in eight months. This rude awakening hit just as economists were toasting to endless growth, proving once again that forecasts are best paired with a healthy dose of humility.

The culprit? A whopping 25% plunge in shipments across the Pacific to the US, where tariffs have turned American shoppers into selective suitors. Sure, exports to everywhere else perked up 3.1%, like a backup band filling in for the headliner, but it wasn’t enough to keep the encore going.

Barclays economists, led by the ever-optimistic Yingke Zhou, warned of a “triple whammy” lurking: property woes that make houses feel like bad dates, consumer spending on life support, and now exports ghosting the rally. It’s as if China’s economy showed up to the growth party in sweatpants—comfy, but not exactly club-ready.

For months, Chinese firms had been globe-trotting like overachieving sales reps, chasing new markets to dodge the US drama. Sales abroad had ballooned every month since February’s Lunar New Year lull, turning potential lemons into export lemonade.

But October flipped the script. Shanghai’s port, that bustling beehive of containers, handled the fewest since April—like a once-rowdy nightclub clearing out early for renovations.

Forecasters? They were caught flat-footed, with Bloomberg’s poll expecting a bouncy 2.9% gain. Only one lone wolf analyst saw the skid coming, probably the guy who always brings an umbrella to barbecues.

Bloomberg Economics’ David Qu chimed in, noting the drop signals external resilience buckling under tariff weight and global jitters. Beijing, he suggests, might need to pump up domestic demand before weak spending turns the whole show into a slow-motion blooper reel.

Trade tensions with the US had escalated last month, but Presidents Trump and Xi’s South Korea summit yielded a deal: a 10% tariff trim starting Monday. It’s like loosening a too-tight belt—relief, but those extra notches from Vietnam’s slimmer figure still pinch.

Yet the boost might fizzle if global demand keeps playing coy. Last quarter, growth hit its weakest in a year despite export fireworks, and analysts now eye this quarter’s pace as the slowest since Covid Zero’s lockdown limbo.

The slump spread like an uninvited guest. EU shipments crawled up just 1%, the snoozefest slowest since February’s flop, while sales to South Korea, Russia, and Canada nosedived double-digits—talk about a cold front.

Homin Lee at Lombard Odier Singapore flags emerging markets as the new crystal ball for Chinese tech and consumer brands’ wanderlust. “Under greater scrutiny,” he says, as if exports are auditioning for a reality show sequel.

Silver linings? Cumulative exports topped $3 trillion in the first 10 months, a speed-record sprint, ballooning the trade surplus to $965 billion—like saving for retirement by skipping coffee runs. October’s imports inched up 1%, netting a $90.1 billion surplus that could fund a small nation’s fireworks display.

The yuan’s glow-up against the dollar made goods pricier abroad, like upgrading to business class only to find the legroom’s the same. But deflation’s fire sale since mid-2023 keeps prices wallet-friendly, turning currency headaches into bargain-bin bonuses.

Latin America and ASEAN felt the squeeze too, hinting Mexico’s import curbs and yuan flex are gatecrashing the party. Still, firms won’t quit the overseas hustle born from US trade spats.

Late October offered a wink of hope: port containers surged 14% in the week ending Nov. 2, as if shipments heard the “last call” and rushed back. Goldman Sachs’ Xinquan Chen team bets on 2026 resilience from structural zephyrs, payback front-loading be damned.

China’s export saga? It’s less a straight-line sprint, more a comedic conga line—two steps forward, one awkward shuffle back. As Beijing eyes year-end rebounds, one thing’s clear: in trade, even the best deals come with fine print and a side of schadenfreude.

Leave a Reply