The stock market took a comedic nosedive last week as investors discovered that artificial intelligence isn’t just here to write your emails—it’s apparently plotting to steal jobs from truck dispatchers and tax wizards too.

Major indexes like the S&P 500 shed 1.4%, the Nasdaq tumbled 2%, and the Dow limped lower by 1.2%, all while Wall Street collectively clutched its pearls over the “dark side of AI.”

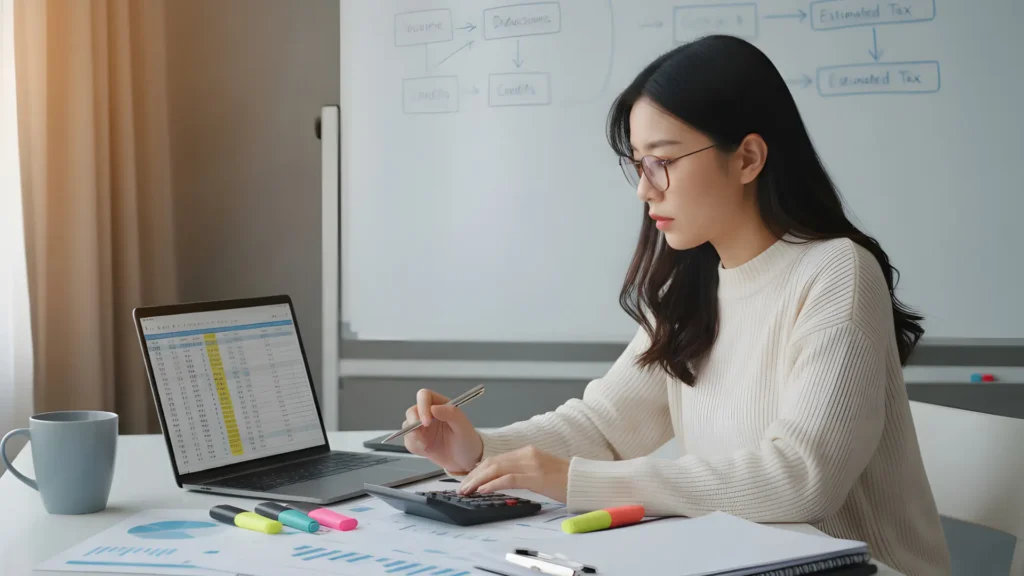

The fallout hit hardest in places no one expected AI to crash the party. Wealth management firms, those bastions of high advisory fees where humans charge premium prices for portfolio wisdom, watched their stocks slide after a startup rolled out an AI-driven tax tool that spits out customized strategies faster than you can say “deductible.”

Charles Schwab dropped around 10% for the week, Raymond James about 8%, as the market wondered if robots might soon handle the heavy lifting of telling rich people how to pay slightly less in taxes.

Logistics and transportation weren’t spared either. C.H. Robinson plunged 11% and Universal Logistics 9% after a Florida-based outfit unveiled a tool promising to scale freight volumes without adding a single extra employee.

Suddenly, the folks who move America’s goods looked nervously at their spreadsheets, realizing AI might optimize routes better than a room full of coffee-fueled planners ever could.

This “AI scare trade” started in software, where giants like Salesforce and ServiceNow have been hammered amid fears that AI agents will handle customer service and workflow tasks for pennies on the dollar. The Tech-Software Sector ETF sits down a whopping 22% year to date. Now the panic has spread like a bad meme, dragging in everything from brokerages to freight brokers.

Analysts, however, are starting to chuckle at the overreaction. Tim Urbanowicz of Innovator Capital Management called it the “dark side” but noted sky-high margins and elevated valuations haven’t budged yet.

He still sees the S&P 500 climbing to 7,600 by year-end, buoyed by friendly regulations, tax perks, and strength in boring-but-reliable sectors like energy, staples, and materials—all up double digits while tech lags.

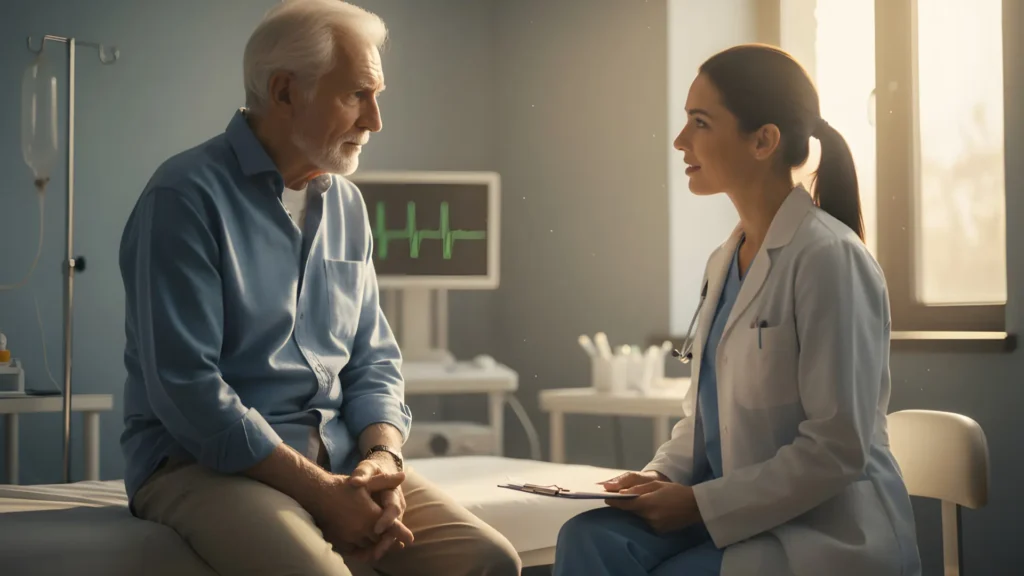

Amanda Agati at PNC Asset Management urged calm, calling the volatility a “short-term blip” amid broader market breadth. UBS strategists echoed the sentiment, suggesting investors embrace companies that wield AI to sharpen operations rather than flee from it—especially in financials and health care.

Leave a Reply