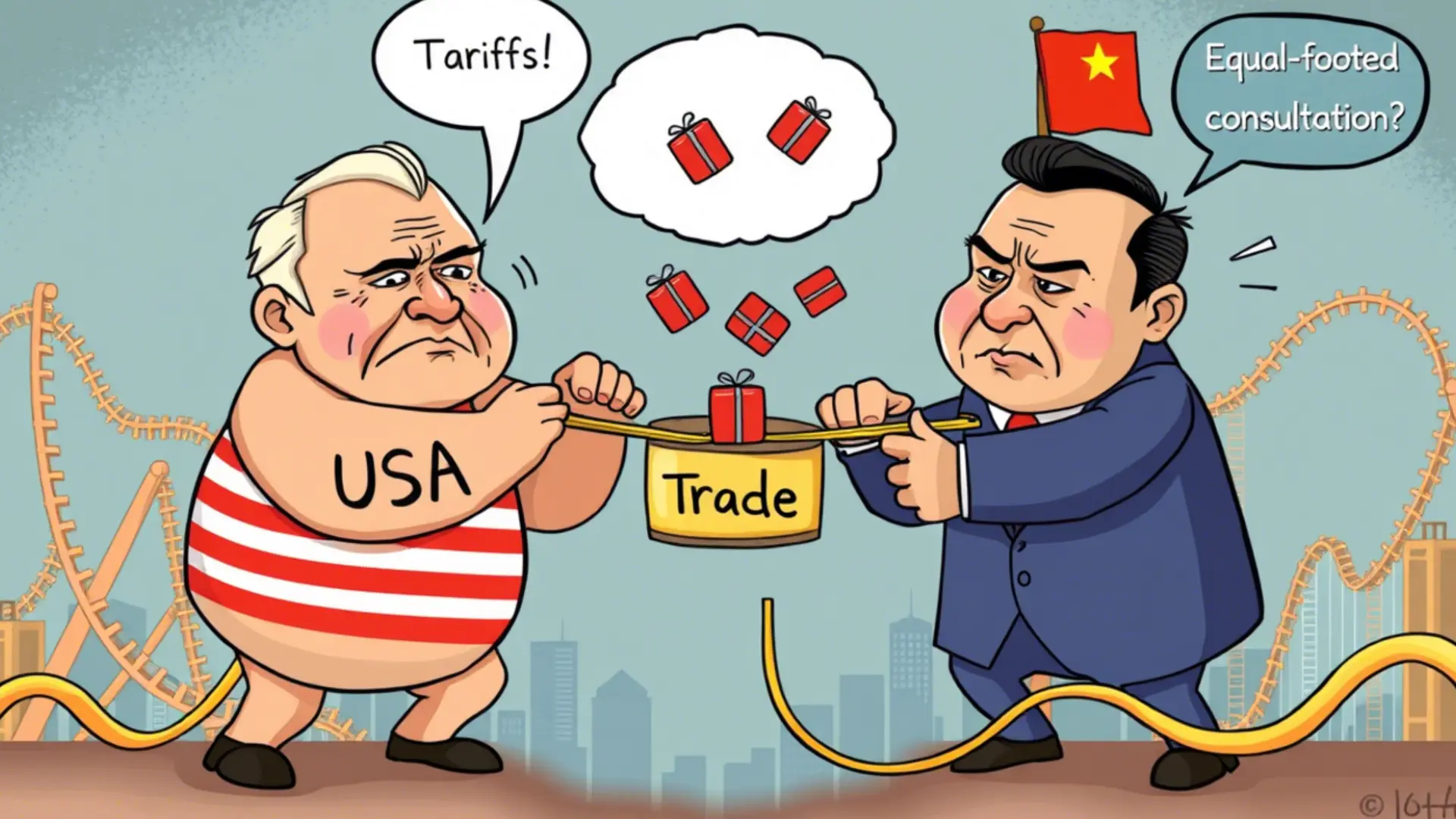

China waltzed into the global trade drama on Saturday, declaring with a straight face (and maybe a wink) that “the market has spoken.” Apparently, Mr. Market wasn’t thrilled about U.S. President Donald Trump’s tariffs—because who doesn’t love an economic curveball? Amid all this chaos, Beijing politely asked Washington to put down its megaphone of protectionism and join them for some “equal-footed consultation.” Spoiler alert: It’s code for let’s talk before things get weirder.

Meanwhile, Chinese commerce associations from healthcare to textiles—and even electronics (yes, your future gadgets are watching)—issued statements faster than you can say “alternative markets.” They urged everyone to band together like Avengers assembling against Thanos. Oh, and they threw in a warning: these tariffs might just turn America’s inflation into a hot air balloon at a county fair.

“The market has spoken,” quipped Guo Jiakun, spokesperson for China’s foreign ministry, while casually posting a picture of Friday’s stock market nosedive on Facebook. If markets could talk, we imagine they’d be screaming something along the lines of, “Help! I’ve fallen, and I can’t get up!”

And speaking of falling… let’s not forget how Trump decided to spice things up by slapping a whopping 34% tariff on Chinese goods. That’s right—almost a third more expensive, because apparently, making friends is overrated. Add that to the existing pile of duties, and now everything coming out of China costs Uncle Sam a cool 54%. To top it off, he plugged a sneaky little loophole that allowed tiny packages from China to slip through duty-free. Who knew bargain-bin trinkets were funding geopolitical chess games?

But wait, there’s more! Like any good telenovela, China retaliated with gusto, unleashing its own set of 34% tariffs on ALL U.S. goods and tightening the screws on rare earth exports. Rare earths, folks—if you don’t know what those are, trust us, they’re important enough to make Elon Musk sweat. This tit-for-tat escalation turned the world’s two biggest economies into squabbling siblings fighting over who gets the last slice of pizza.

Global stock markets responded by plummeting faster than a cat spotting a cucumber behind it. Investors everywhere clutched their pearls as Trump confidently declared he wouldn’t budge—an announcement so stubborn it gave the S&P 500 flashbacks to 2020. For the week, the index dropped a jaw-dropping 9%, proving once again that volatility loves company.

Guo Jiakun chimed in one last time, writing in English, “Now is the time for the U.S. to stop doing the wrong things.” Translation? Stop poking the dragon unless you want barbecue sauce on your hands. He suggested resolving differences through calm negotiation instead of turning international trade into a reality TV show.

China’s food products chamber joined the chorus, urging its members to unite like a team of culinary superheroes. Their mission? Explore new markets both domestically and abroad. Meanwhile, the metals and chemicals crew issued their own dire prophecy: these tariffs will jack up costs for American importers and consumers alike, stoking inflation like someone tossed gasoline onto a campfire. And if inflation rises too high? Well, let’s just say the U.S. economy might need smelling salts—or possibly a defibrillator.

So here we are, folks: two superpowers duking it out over dollars and cents, leaving the rest of us wondering if we should invest in popcorn or bunker supplies. Stay tuned for Season Two of Trade Wars: The Musical .

Leave a Reply