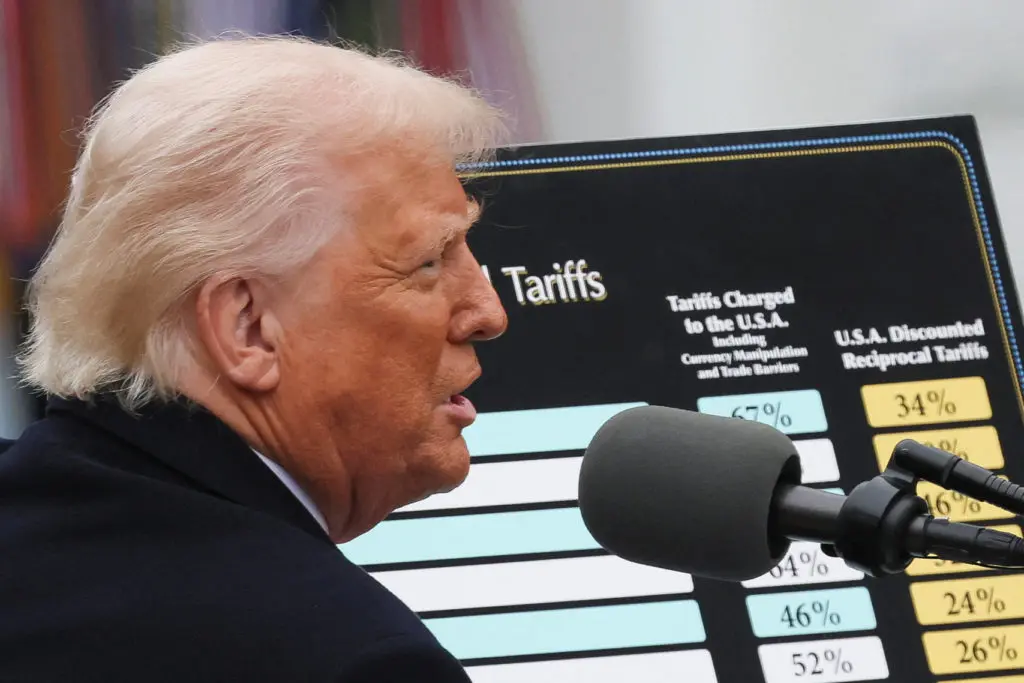

Tariffs, shmarriffs—who needs ‘em? Oh wait, we do! And apparently, so does President Donald J. Trump, who just slapped some hefty price tags on everything from your favorite sneakers to that $1,000 iPhone you swore you’d never buy but probably will anyway.

But don’t worry—your wallet’s about to feel like it went through an emotional rollercoaster designed by Willy Wonka himself.

The Everyday Life Tax Hike Extravaganza

Let’s start with Kimberly Clausing, a professor at UCLA Law and former Treasury Department economist, who dropped this gem: “These tariffs are going to raise prices for American people in ways that make grocery shopping feel like playing Monopoly—but without the fun or fake money.” Translation? Get ready for what could be the biggest tax hike since bell-bottoms were cool (that’s 50 years ago, folks). It’s not subtle; it’s universal. Economists say virtually everything is getting pricier. So buckle up, buttercup—it’s gonna get expensive.

Coffee Catastrophe Strikes Again

Ah, coffee—the magical elixir that keeps us alive until noon. Well, guess what? Your morning cup o’ joe might soon cost more than your rent. Walter Haas, owner of Graffeo, a San Francisco coffee roastery older than most grandparents, says he’ll feel the pinch faster than you can say “espresso.”

His green beans hail from Colombia, Costa Rica, and Papua New Guinea—all now facing 10% tariffs. That means higher costs for him, which translates into higher costs for you.

“I’ve already raised prices 8% this year,” Haas groaned, clearly tired of being everyone’s least-favorite barista. “If these tariffs stick around, they’ll be baked into the price forever. Like Grandma’s fruitcake, except less edible and way more caffeinated.”

And then there’s Dina DiCenso, co-owner of Rind vegan cheese (yes, vegan cheese exists, and yes, it’s delicious). She uses cashews imported from India and Brazil, and her supplier has warned her of potential price hikes as high as 25%. Yikes. “I don’t know how much higher we can go,” she said, looking increasingly panicked. “But if we have to cover all these extra costs, I may need to start selling luxury truffles instead.”

Even her U.S.-made products aren’t safe. Thanks to immigration crackdowns, her veggie farmers can’t find enough workers to pick carrots and peppers. Meanwhile, rising fuel costs mean even her delivery trucks are staging their own little rebellion. “Everything’s falling apart,” she sighed. “Even when things break down, fixing them costs more because parts are taxed too. Welcome to the food industry apocalypse!”

Fashion Frenzy: When Clothes Become Luxury Items

Move over, Gucci—H&M and Gap are officially joining the high-fashion club. Analysts report that tariffs of 46% on goods from Vietnam and 37% on imports from Bangladesh caught retailers completely off guard. Nike, Target, Walmart, and Amazon shoppers beware: those yoga pants and sneakers you love? They’re about to get pricey.

Oh, and let’s talk loopholes—or rather, lack thereof. Remember when Chinese companies like Shein and Temu could sneak past tariffs using the “de minimis” exception? Yeah, well, goodbye loophole. Now, those shipments face either 30% taxes or $25 per item.

Steve Lamar, president of the American Apparel & Footwear Association, summed it up perfectly: “To be clear, tariffs are taxes borne by Americans. Every piece of clothing, every shoe, every accessory becomes pricier. Because nothing screams ‘necessity’ like paying five times more for socks.”

Cars: Driving Off Into the Pricey Sunset

Car dealerships aren’t immune either. While they typically stockpile vehicles for a month or two, expect sticker shock come summertime. Brands like Toyota, Honda, and Subaru—which rely heavily on imports—are especially vulnerable. And here’s the kicker: even cars made domestically contain foreign parts.

Industry experts predict an average markup of $6,000 per vehicle. Charlie Chesbrough, senior economist at Cox Automotive, put it bluntly: “Prices are rising almost immediately. Compact SUVs? Kiss those affordable prices goodbye.”

Electronics: The iPhone Gets Schooled

Finally, let’s pour one out for Apple lovers everywhere. iPhones, once tariff-free during their China manufacturing days, are now staring down a whopping 54% tariff. For a $1,000 iPhone, that’s an additional $250 smackeroo. TVs, smartwatches, video game consoles—you name it, it’s affected.

Gary Shapiro, CEO of the Consumer Technology Association, summed it up best: “President Trump’s tariffs are massive tax hikes on Americans. Enjoy paying extra for your gadgets!”

Leave a Reply