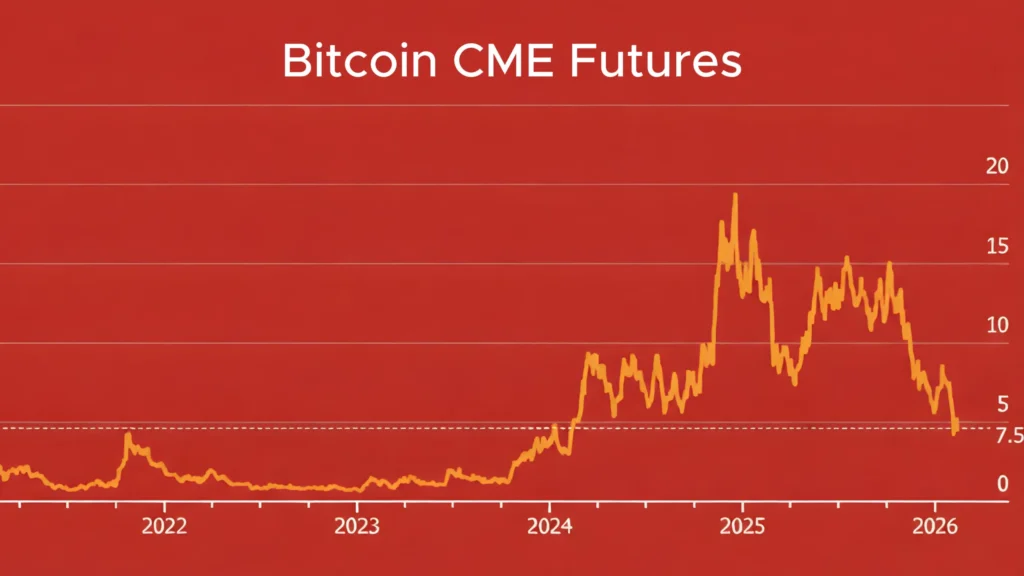

The so-called SaaS-pocalypse, where artificial intelligence is apparently plotting to turn billion-dollar software empires into yesterday’s news.

Investors have suddenly decided that the same AI everyone cheered as the next big thing might actually be the grim reaper for subscription-based software.

Shares in SaaS heavyweights are tumbling faster than a toddler on roller skates, with fears that tools like Anthropic’s Claude can now handle complex tasks in plain English, making expensive specialized apps feel about as essential as a fax machine in 2026.

The carnage has been spectacular. Australia’s tech index, packed with stars like Xero and WiseTech, has shed around 17% this year alone—more like a tech tragedy than an index. Across the Pacific, Atlassian’s collaboration tools have taken a 50% haircut since January, costing founders Mike Cannon-Brookes and Scott Farquhar a combined $US8 billion in paper wealth.

That’s the kind of drop that makes even billionaires check their couch cushions for spare change. Meanwhile, the broader software sector has watched hundreds of billions vanish, as Wall Street swings between “AI will save us all” and “AI will eat our lunch—and then ask for seconds.”

The beauty of it all? Markets are somehow terrified of both too little AI (bubble fears) and too much AI (disruption panic) at the exact same moment. It’s like worrying the party will be boring and also that it’ll get too wild—classic investor logic.

It started innocently enough. ChatGPT burst onto the scene years ago, and everyone piled into tech stocks like kids at a free candy store. Then came the sobering thought: why shell out for fancy accounting software when you can just politely ask an AI to crunch the numbers?

Enter Anthropic’s recent upgrades. Their Claude models now let users chat naturally with computers to tackle data analysis, expense tracking, and more—no need to master clunky interfaces or pay per user seat. Suddenly, the “per seat” pricing model that made SaaS fortunes looks as durable as a house of cards in a wind tunnel.

The sell-off hit Australian shores hard. Xero’s accounting suite? Under siege. WiseTech’s logistics platform? Feeling the heat. Atlassian’s Jira and Confluence empire? Investors are treating it like yesterday’s project management flavor.

Experts are trying to calm the herd. Luke McMillan from Ophir Asset Management points out that some companies have real “economic moats”—proprietary data AI can’t touch, or complex systems that won’t vanish overnight. Others might even weave AI in, turning threat into turbo-boost. Morningstar’s Lochlan Halloway agrees: there’ll be winners who adapt and losers who cling to old ways like a flip phone in the smartphone era.

Still, the panic feels familiar. Remember when digital cameras supposedly killed Kodak overnight? Markets love a dramatic narrative—today it’s “SaaS-pocalypse,” tomorrow it might be something else. Volatility reigns, fueled by AI hype, Trump-era trade jitters, and traders chasing the next shiny story.

Eventually, the dust settles, valuations adjust, and survivors emerge stronger. Until then, enjoy the show: software stocks are down, AI is up, and everyone’s pretending they saw this coming.

Leave a Reply