Micron Technology delivered revenue of $13.64 billion and adjusted earnings of $4.78 per share on December 17, far surpassing expectations.

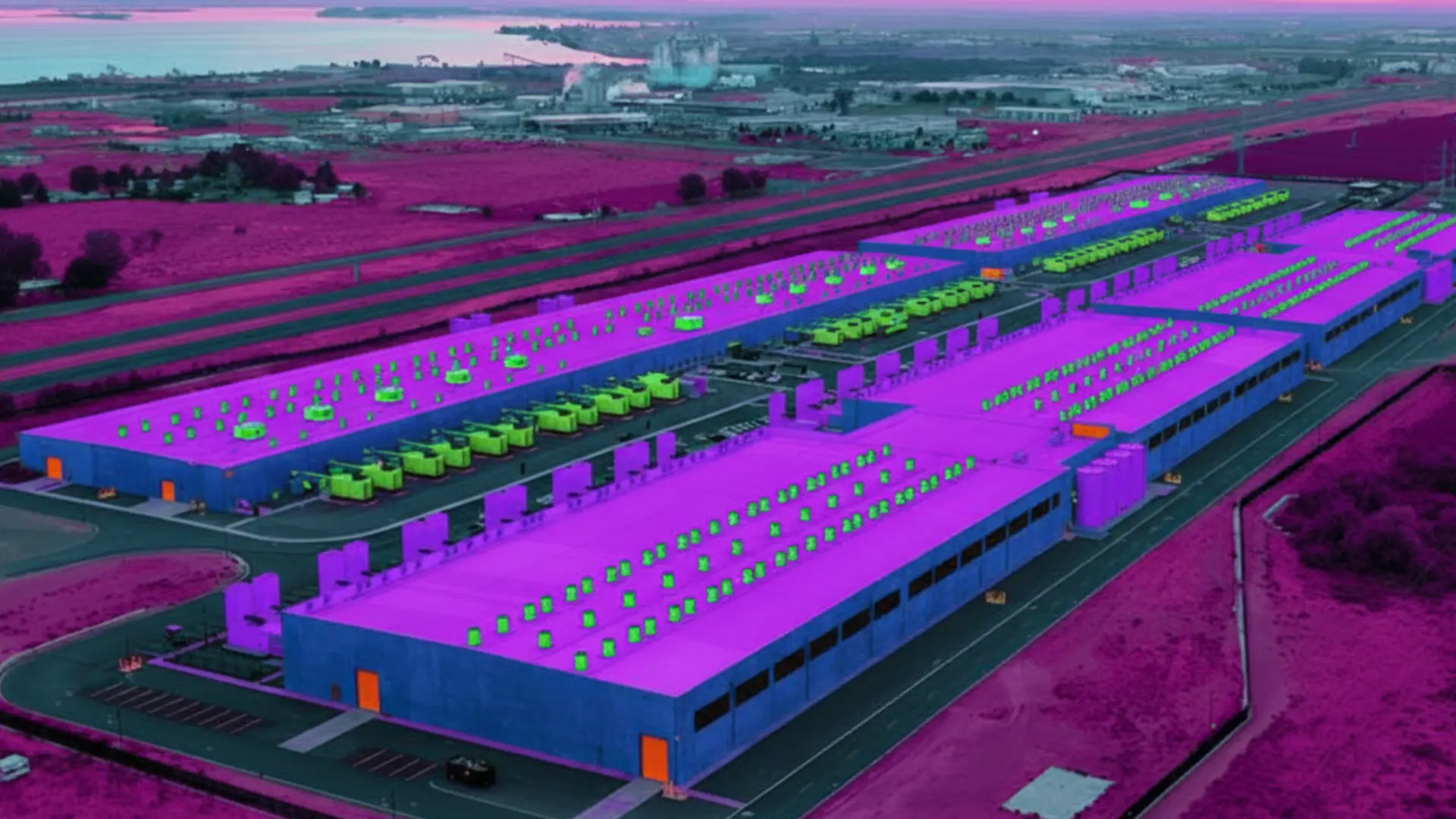

The secret sauce? An insatiable appetite from AI data centers for high-bandwidth memory, turning what was once a sleepy chip market into a gold rush.

This triumph for Micron translates directly into tougher times for anyone shopping for a new laptop, smartphone, or even a car.

Memory prices have already surged, with some modules tripling in cost over the year, and the squeeze shows no signs of easing soon.

Budget devices feel the bite hardest, as manufacturers juggle rising bills without much wiggle room.

Game consoles, medical devices, and embedded systems quietly share the same fate.

Consumers end up paying more for less, all while server farms enjoy priority service.

Micron’s latest results mark a pinnacle in an industry known for its rollercoaster rides.

CEO Sanjay Mehrotra pointed to accelerated AI demand and flawless execution as the drivers behind record revenues and margins.

The company sold out its high-bandwidth memory supply well into next year.

Cloud memory sales doubled annually, highlighting where the real action lies.

Yet this focus comes at a cost to the broader ecosystem.

Earlier in December, Micron confirmed its exit from the consumer Crucial brand, wrapping up shipments by early 2026.

Production lines now prioritize enterprise and AI clients.

High-bandwidth memory offers fatter margins than the standard DDR found in personal devices.

With only three dominant players—Micron, Samsung, and SK Hynix—controlling the market, supply for everyday needs lags badly.

Prices reflect the imbalance sharply.

DDR5 modules that once retailed modestly now command premium tags.

Contract negotiations yield steep quarterly hikes.

PC makers stockpile whatever they can secure.

Retail limits curb hoarding attempts.

Micron plans hefty capital spending to expand advanced capacity.

Relief for standard memory users remains on a distant horizon.

Industry cycles typically swing from shortage to glut.

This one persists longer, fueled by relentless data center expansion worldwide.

Server units grew strongly this year, with more projected ahead.

Smartphone and PC demand holds steady, adding pressure.

Device makers offset costs by trimming features elsewhere.

Some delay releases until supply improves.

Experts foresee tightness extending into 2027 or beyond.

Micron’s shares celebrated the news with hearty gains.

Investors applaud the strategic alignment with AI trends.

For those planning hardware upgrades, the outlook proves considerably less festive.

Basic memory upgrades morph into notable expenses.

Data centers continue their feast unabated.

Personal tech users settle for the scraps, adapting as best they can.

Leave a Reply