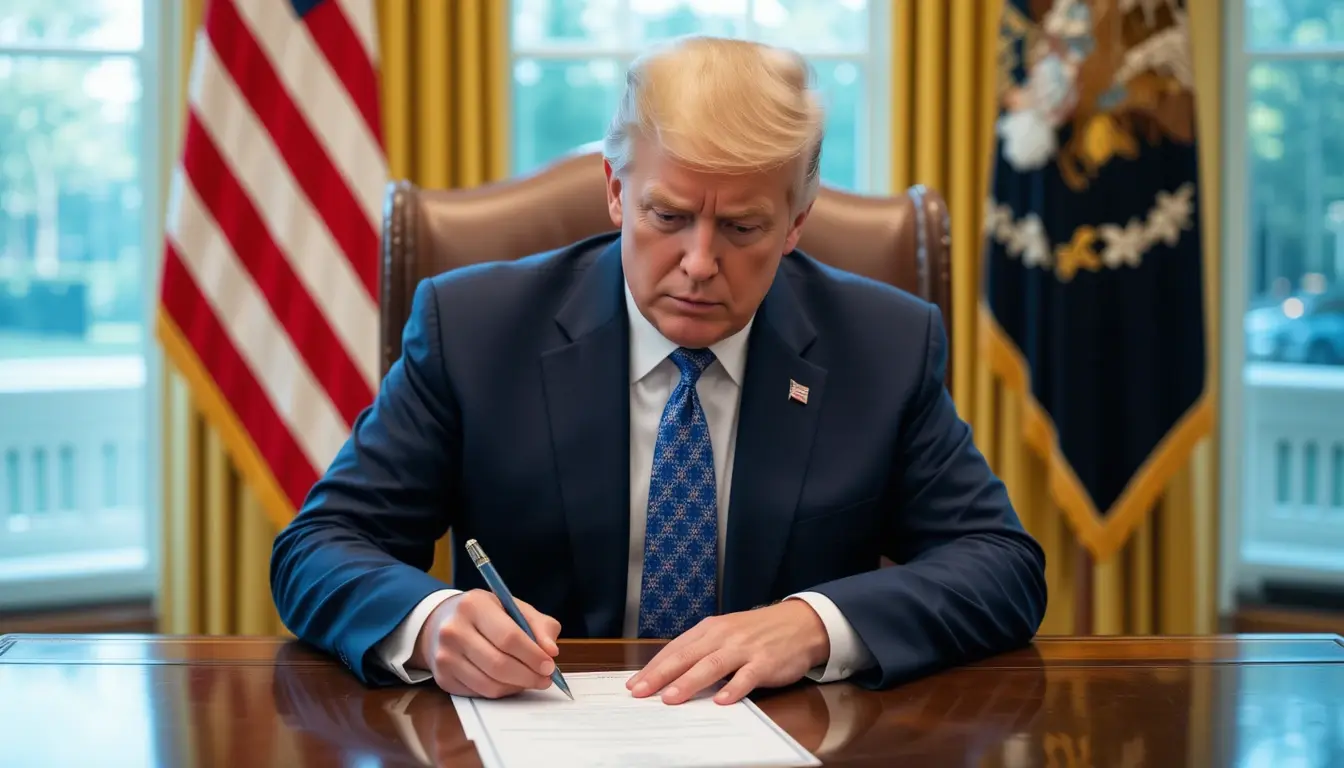

President Donald Trump has turned “debanking” into his latest soap opera, and it’s got Wall Street chuckling nervously. On Tuesday, he spilled the tea on CNBC, claiming major banks gave him the cold shoulder despite his hefty cash piles.

He’s now pushing an executive order to snoop on banks for allegedly shunning customers over political or religious vibes.

Debanking, for those not in the know, is when a bank slams the door on a customer’s face. It happens for all sorts of reasons—bad credit, sketchy business deals, or maybe just a vibe that screams “trouble.” Trump insists it’s a political hit job, especially against his MAGA crew and crypto pals.

Trump’s tale is a wild one. He says JPMorgan Chase, where he parked hundreds of millions, told him to take a hike with just 20 days’ notice. Then, he dialed up Bank of America’s CEO Brian Moynihan, offering a cool billion in deposits, only to get a polite “nope.”

JPMorgan didn’t spill details but swore they don’t play the political rejection game. Bank of America, meanwhile, took a smoother route, with Moynihan suggesting Trump’s beef is really with pesky regulators. Both banks are probably sweating a bit, wondering if they’re about to star in the president’s next tweetstorm.

The executive order, which might drop any day now, is set to make banks squirm. It’ll push regulators to dig into whether banks are breaking laws like the Equal Credit Opportunity Act by playing favorites with accounts. Fines and stern lectures could follow for those caught in the act.

Conservatives have been grumbling about debanking for years, claiming banks are allergic to their views. Crypto folks, too, say they’ve been locked out, especially during the Biden years. They point to “Operation Choke Point 2.0,” a theory that regulators tried to freeze them out after crypto’s 2022 crash, which wiped out $2 trillion faster than you can say “blockchain.”

But here’s the kicker: banks aren’t legally obligated to open their doors to everyone. Americans don’t have a VIP pass to a checking account. Banks can say “pass” if they sniff risk, whether it’s dodgy finances or a reputation that raises eyebrows.

Lawmakers report over 8,000 complaints in three years about accounts getting the boot, plus 4,000 gripes about banks refusing to open new ones. That’s a lot of folks feeling snubbed, but banks stay tight-lipped about specific cases. It’s like trying to get gossip from a vault.

Trump’s not alone in his debanking woes. His wife, Melania, wrote in her 2024 memoir about her shock when her bank account got the axe. Even their son Barron couldn’t snag a new account, which sounds like a family reunion at the rejection desk.

The crypto crowd’s complaints add spice to the drama. They argue Biden’s regulators had it out for them, especially after the FTX meltdown landed its CEO in jail. But banks counter that they’re just following rules to avoid money laundering or fraud, not picking political fights.

JPMorgan’s CEO Jamie Dimon has been vocal, insisting they don’t ditch clients over politics. He’s even begged for clearer rules to avoid these messes. Meanwhile, Moynihan’s playing diplomat, hoping to dodge Trump’s wrath by agreeing regulators need a leash.

This isn’t Trump’s first rodeo with banks. He’s been vocal since January, calling out Moynihan at the World Economic Forum for allegedly shunning conservatives. The Trump Organization even sued Capital One after the Jan. 6 Capitol chaos, claiming their accounts got canned for political reasons.

The executive order could shake things up. It might force banks to rethink how they handle “risky” clients, especially in hot-button sectors like crypto or conservative causes. But critics warn it could also tie banks’ hands, making it harder to dodge actual fraudsters.

Banks are already trying to play nice. JPMorgan and others have tweaked policies to swear they’re not political snobs. Some have even ditched climate groups targeted by conservative states, hoping to avoid trouble.

Leave a Reply