Asian stock markets woke up on the wrong side of the bed Friday, slipping slightly as investors braced for the U.S. payrolls report, which everyone seems to think might drop a stink bomb. The MSCI Asia-Pacific index, excluding Japan, dipped 0.2%, though it’s still eyeing a 2.1% weekly gain, like a kid who fell off the slide but still wants to brag about the playground. Japan’s Nikkei, the oddball of the bunch, climbed 0.4%, trimming its weekly loss to a respectable 0.7%.

Meanwhile, Tesla’s stock took a 14% nosedive, shedding $150 billion faster than a kid loses interest in a new toy. The culprit? A very public spat between two bigwigs who used to be chummy, now slinging mud over government contracts and tax credits. After-hours trading saw Tesla recover a measly 0.8%, which is about as comforting as a Band-Aid on a broken leg.

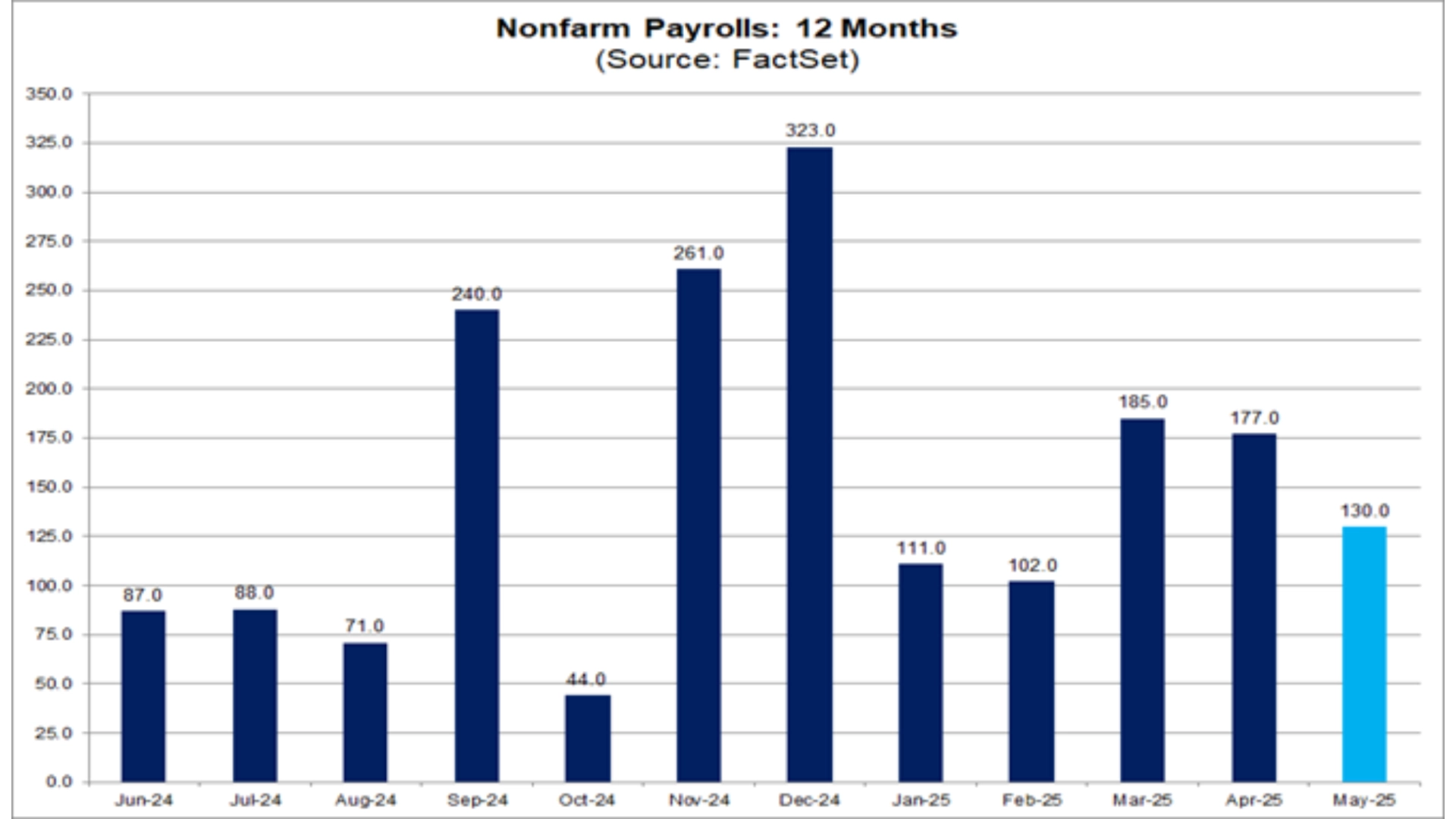

The U.S. payrolls report has markets on edge, with whispers of stagflation creeping in like uninvited guests at a barbecue. Recent data, including a 47% surge in Challenger layoffs and a disappointing ADP private payrolls report, has everyone expecting a measly 130,000 new jobs for May, with unemployment holding steady at 4.2%. TD Securities, ever the pessimists, predict a mere 110,000 jobs, which could send Treasury yields into a tizzy and spark dreams of Federal Reserve rate cuts by September.

Across the Pacific, Chinese blue chips and Hong Kong’s Hang Seng didn’t get the memo about optimism, dropping 0.2% and 0.5% respectively. A phone call between two world leaders offered all the clarity of a foggy windshield, leaving trade tensions simmering like a pot of forgotten soup. Luke Yeaman from the Commonwealth Bank of Australia tried to stay upbeat, noting that at least the leaders are talking, but admitted there’s about as much goodwill between them as cats and dogs sharing a couch.

The dollar, meanwhile, is acting like it forgot its lines, inching up 0.2% but still wobbling near a six-week low after some lackluster economic numbers. The euro, strutting its stuff, hit a six-week high of $1.1495 after the European Central Bank trimmed rates but hinted it’s almost done playing nice. Investors, reading the tea leaves, are betting on no rate moves until maybe December, which feels as far off as next year’s tax season.

In the commodities corner, oil prices are playing coy, dipping 0.4% to $63.12 a barrel but still up 3.8% for the week, thanks to supply jitters. Gold, the shiny safe haven, climbed 0.4% to $3,366.78 an ounce, racking up a 2.3% weekly gain. It’s the kind of performance that makes investors feel briefly smug before the next market hiccup.

Back to the Tesla drama, cooler heads might be prevailing, with a scheduled call to smooth things over, like a sitcom where everyone hugs it out by the end. Nasdaq futures ticked up 0.3%, and S&P 500 futures nudged 0.4% higher, while European futures are only down a smidge, suggesting markets might be ready to kiss and make up. Still, with the payrolls report looming, everyone’s holding their breath like they’re waiting for the punchline at a bad comedy show.

Wall Street had its own rough day Thursday, with Tesla’s slump dragging down the mood like a rainy day at a picnic. The broader market’s focus on trade talks and tariffs didn’t help, though some progress there kept things from going completely off the rails. Investors are now glued to Friday’s payrolls data, hoping it doesn’t confirm their worst fears about a slowing economy.

The Federal Reserve, caught in the crosshairs, faces pressure to ease policy if the jobs numbers disappoint. Kansas City Fed President Jeff Schmid’s comments about tariffs possibly stoking inflation didn’t exactly calm anyone’s nerves. Fed Chair Jerome Powell, playing the cool-headed parent, is holding off on rate cuts, waiting for more data like a chef checking if the cake’s done.

Markets are jittery, and for good reason—between billionaire feuds, trade standoffs, and a jobs report that could go either way, it’s a bit like juggling flaming torches. If the payrolls number tanks, expect a mad dash for Treasuries and renewed chatter about rate cuts. If it surprises to the upside, maybe everyone can exhale and focus on something less stressful, like what to eat for lunch.

For now, the world’s markets are stuck in a waiting game, watching the U.S. jobs data and hoping the big players can keep their tempers in check. It’s a wild ride, but at least it’s not boring. Stay tuned for the next episode of “As the Market Turns.”

Leave a Reply